No products in the cart.

Forex Trading

Vehicle Loan Apply New Car Vehicle Loan at Low Interest Rate

Special offers – There could possibly be special provides available when you are making use of in your mortgage. The bank you choose will collect your documents and initiate the application processing, which includes checking your CIBIL score, the value of the asset , eligibility conditions, and more, and then give a decision on your loan application based on the evaluation results. With this homework, you will negotiate the loan repayment tenure and EMI matters confidently with the bank representative. Do not forget to consider the total cost of car ownership when you are at it. Use our car loan EMI calculator and figure out the EMI you have to pay for a given loan amount and repayment tenure. With this tool, you will figure out the approximate loan tenure you are comfortable with and the EMI you can handle every month.

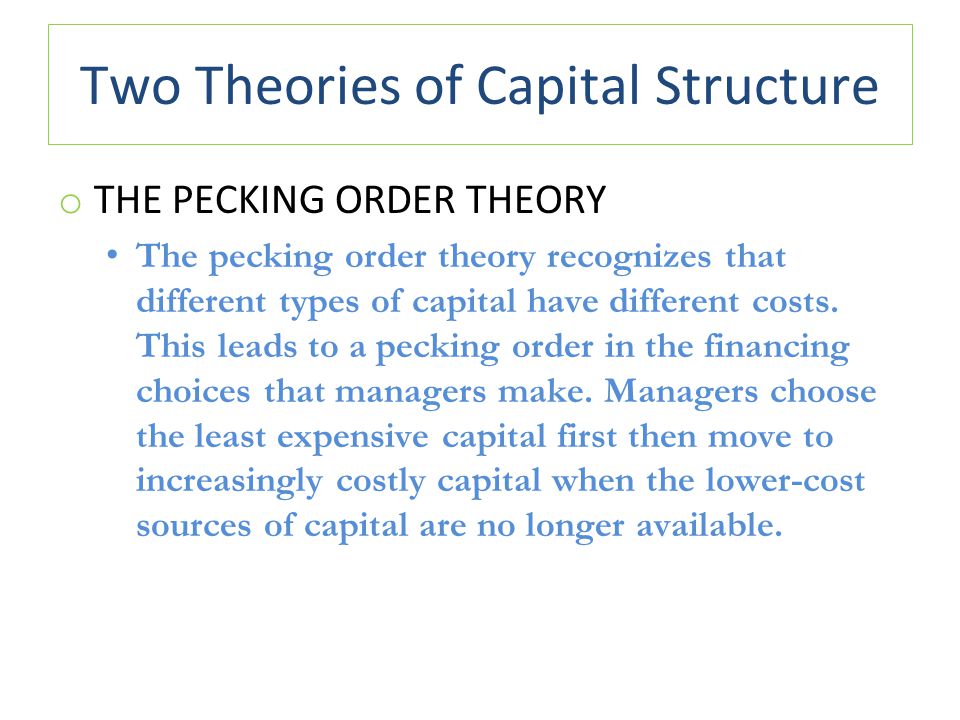

You may have settled with your earlier loan due to a lack of options. However, with refinancing, you will be able to change a number of things like loan tenure, co-signer details, terms related to late fees, insurance, application charges, hypothecation, and so on. As mentioned above, you might be able to pay lower interest if there is a fall in the interest rate or auto loan definition if there is a change in your credit score. Similarly, if you change the repayment terms in such a way that you are paying higher EMIs, the interest paid goes down then too. If your credit score has improved since the time you have taken the loan, there is a chance that you will be charged a lower interest rate or at least have better repayment terms in general.

SERVICE CHARGES

Hypothecation gives the right to the lender to seize your asset, i.e., your car, for instance, if you do not pay the EMI on time. You may get additional discounts and offers if you choose to purchase a car from the dealer or manufacturer the bank has a tie-up with. Used cars are usually a lot more affordable and ideal for people who have recently learned to drive. Depending on the age of the used car, it may require regular maintenance from time to time, which can lead to added costs. However, it typically runs smoothly for years without incurring extra maintenance costs. Today, you can take on a Vehicle Loan to buy various kinds of vehicles in India.

Lenders base the amount of an accredited auto loan on a car’s market value. Using the automotive’s yr, make, model and options, the lender determines a automobile’s value. These loans are not for personal use and hence, are offered only to businesses for capital expenditure and business expansion amongst others. They are often tailor-made to suit the financial needs of MSME businesses. There are also various benefits of using this loan to raise capital. The benefits include a requirement of minimal documentation, quick and easy disbursal of the required funds, as well as flexibility in repayment of the loan.

We achieve this with a cutting edge combination of data science and technology that ensures that both lenders and borrowers have a transparent common platform to make their decisions. We treat your data with the utmost confidentiality and will never share or sell it to anyone. Our dedicated and best-in-class customer service will go the extra mile to support you on every step of your credit journey. A commercial vehicle loan provides funds to borrowers to purchase a vehicle to individuals and organizations for commercial use. It is similar to a car loan; however, car loans are specifically catered towards private vehicles. A commercial vehicle loan finances the purchase of commercial vehicles.

- Individuals between 18 to 75 years, irrespective whether salaried or self-employed, are eligible, subject to certain conditions.

- The repayment tenure of term loans ranges between 12 months to 60 months.

- That institution agrees to loan you money to buy the car, and you agree to pay back the amount you borrowed through monthly payments, plus interest.

- CAs, experts and businesses can get GST ready with Clear GST software & certification course.

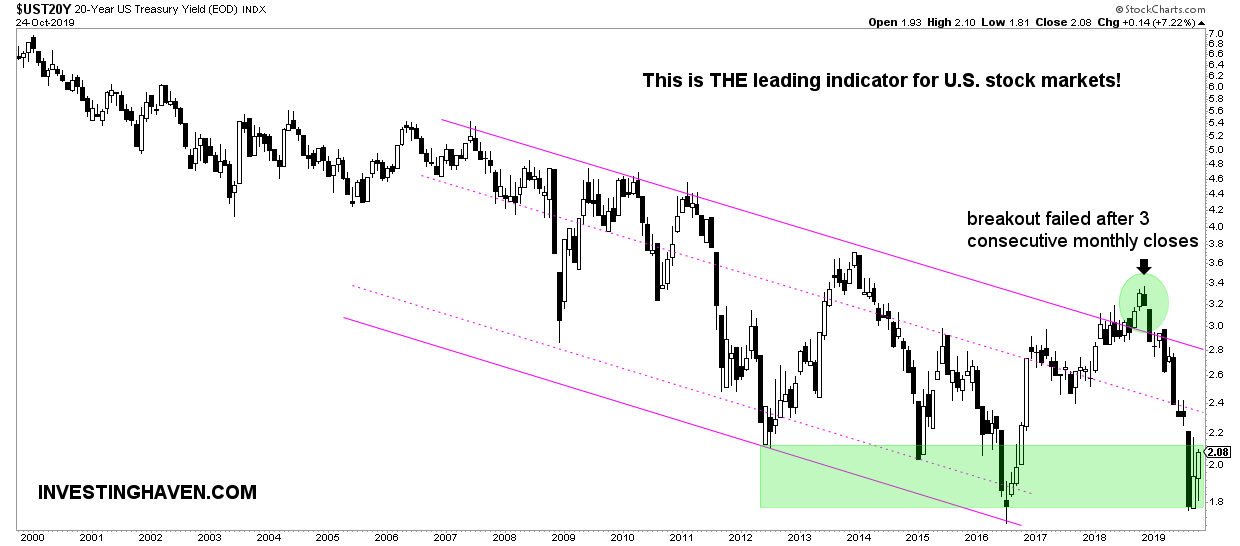

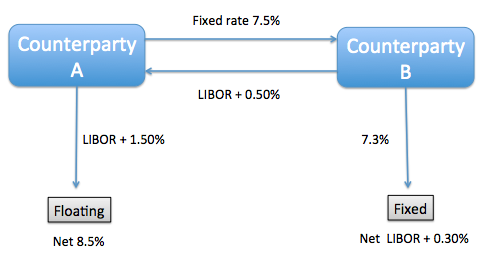

- These interest rates could have been linked to LIBOR (London Inter-Bank Offered Rate), or Prime Lending Rate , or Repo Rate linked, or MCLR based, etc.

No financing of old vehicles on the basis of duplicate Registration books. “…the passenger vehicle segment is doing well on the back of pent-up demand, exciting new launches, growing preference for environment-friendly vehicles and adequate liquidity in the financing system,” Piyush Parag, deputy vice president – fundamental research, Sharekhan, said. Bajaj Finance offers a loan against securities , which can be used to meet your financial needs.

Medium Term Loan:

Once the documents are verified, the loan will be sanctioned. This commercial vehicle loan is offered to customers for purchasing brand-new automobiles. Usually, banks offer up to 100% of the base value of the vehicle. Some banks may also offer additional funds for added features, such as body construction on trucks or mixers used in the transportation business. Reed recommends shoppers check their very own credit score by obtaining preapproved financing. They ought to go to a bank or credit score union and apply for an auto mortgage before visiting the dealership.

New cars have a higher Insured Declared Value, i.e., is the maximum amount you can get when you file an insurance claim. Due to a higher IDV, insurance premiums for new cars are higher than for used cars. Most lenders allow you to apply for a Vehicle Loan online without any physical documentation.

Based on one’s affordability, it is now quite easy to take a car loan and then pay EMIs without really biting into a person’s finances. A Two-wheeler is an excellent vehicle that allows you to navigate traffic, especially in a densely-populated city. It is compact, requires less fuel and helps you cover shorter distances comfortably. With Two-Wheeler Loans, you can buy geared motorbikes and non-geared scooters. Most lenders offer up to 100% financing on Two-Wheeler Loans, with a maximum repayment tenure of five years.

You can even lower your equated monthly instalments by selecting a longer repayment tenure with a brand new lender by way of car refinancing. The rate of interest you’ll get is dependent upon your credit score and revenue, the size of the loan you select and the car. If you have a mortgage and make consistent, on-time funds and your credit score score improves, you might have the ability torefinance your automobile loanto get a better price and decrease your month-to-month fee. CreditMantri was created to help you take charge of your credit health and help you make better borrowing decisions.

To safeguard against misappropriation of funds, the beneficiary’s Bank name and if possible, Bank a/c number should be ascertained from the beneficiary and mentioned in the draft/B/C. BM/RACPC head / sanctioning authority not below rank of Chief Manager will have the discretion to grant a higher loan, subject to EMI/NMI percentage not exceeding 60% in case of tie-ups with reputed PSUs/ corporates or institutions or owing to strategic reasons. It may be relaxed up to 70% by sanctioning officer not below the rank of AGM for customers with NMI of Rs. 10 lac and above. The sharp increase in loans so far has been driven by a rise in demand for vehicles amid the economic recovery after Covid-led disruptions.

What is an auto loan quizlet?

Auto Loan. A loan made by a bank or other lender to an individual so that person can purchase a new or used vehicle, using the vehicle as a collateral for the loan.

Two Wheeler Loans and Commercial Vehicle Finance come with a five year repayment period, while you can repay your new Car Loan over seven years. Lenders usually offer vehicle financing starting from 75% to 100%. As such, you need not worry about putting down hefty down payments. Owning a car or a bike gives you the freedom to commute at your own time and pace. However, with every passing year, the prices of vehicles are increasing.

QUANTUM OF FINANCE

Lenders offer a flexible repayment period generally stretching between 1 and 7 years. Processing fees are charged when the application is processed. It varies from one bank to another and is in the 0.4-1% range of the loan amount. While taking a loan for a pre-owned car, there are many costs like re-registration charges which are not covered. When you buy via a loan, your car is hypothecated to the lender.

Input the numbers for the fields, such as the principal loan amount , loan tenure , and interest rate ®, to calculate the EMI you will have to pay to settle the loan. Bank appeals to all the customers not to respond to such phone call/email/SMS and not to share their bank account detail with any one for any purpose. Never share your CVV/ PIN No. of Debit/Credit card to anyone. Taking a loan for a pre-owned car can be expensive as compared to one on a new car as the interest rate charged by most banks is higher on the former. The amount can be of the ‘Ex-showroom’ price or the ‘On-Road Vehicle’ price. Hypothecation can be removed by visiting the Regional Transport Office along with documents such as No Objection Certificate , car insurance papers and address proof.

• Loan processing and prepayment

The minimum amount that you are expected to pay every month is the EMI. Latest salary slip showing all deductions and TDS certificate-Form 16 in case of salaried persons. When you’re planning to avail a loan, make sure you discuss it with your family. Sharing your rationale with them will keep them well-informed and their opinions will help you gain a better perspective. Even it is a surprise, keeping your family in the dark may not be in their best interest.

The deductions shall be of such amounts, and to such extent, as ICICI Bank may communicate to the Borrower/ s’ employers. The Borrower/s shall not have, or raise/create, any objections to such deductions. No law or contract governing the Borrower/s and/or the Borrower/s’ employer prevents or restricts in any manner the aforesaid right of ICICI Bank to require such deduction and payment by the Borrower/s’ employer to ICICI Bank. Each bank may charge a separate processing cost and paperwork fee.

Following documents are required on specified format:

Though not everyone has enough cash to buy a vehicle in one lump sum, a car loan from a lender might help you realize your goal of owning a car. Car Loan is usually give upto 36 times of net monthly salary and 90% of the cost of car value depending on the repaying capacity such that the overall deuctions does not exceed 65% of Gross Income . One feature of chattel mortgage which differs from consumer loan is that your bank or the mortgage company will secure the loan using the ‘chattel’ or the vehicle which you are planning to purchase. Chattel mortgage generally carries a lower rate of interest, flexible payment structure, and thus proves to be better especially for business owners. Finance minister Nirmala Sitharaman has called a special meeting of state-run lenders later this week to seek their views on heightened global concerns over the banking system’s vulnerability due to monetary tightening. The Federal Reserve on Wednesday raised interest rates by a quarter of a percentage point, but indicated it was on the verge of pausing further increases in borrowing costs amid recent turmoil in financial markets spurred by the collapse of two US banks.

You can also prepay your loan before the stipulated tenure without incurring any penalties. As part of our efforts to make the end consumer services affordable and available at price points which are favourable to the customer, CreditMantri may receive fees / commissions from lenders. CreditMantri will never ask you to make a payment anywhere outside the secure CreditMantri website. DO NOT make payment to any other bank account or wallet or divulge your bank/card details to fraudsters and imposters claiming to be operating on our behalf.

It is, however, a wise move to check the list of cars that can be financed by the lender for the maximum amount offered with fewer charges involved. Low charges are restricted to the most certified clients with glorious credit score profiles, and never all mortgage applicants will be approved to obtain credit from automakers. Ranging from 300 to 850, FICO credit scores are computed by assessing credit cost historical past, excellent debt, and the size of time which a person has maintained a credit line. Make certain you benefit from them Don’t decide a automobile with a high service value because you have already got the EMI and the insurance premiums to pay. Insurance – Check the insurance premium for the automotive as it is a recurring value. Unless you and your spouse have sufficient cash lying round to pay for a automotive in full, you will doubtless use an auto loan to finance the purchase.

What is the meaning of auto loan?

A Vehicle Loan is a loan that allows you to purchase two and four wheelers for personal use. Typically, the lender loans the money (making a direct payment to the dealer on the buyer's behalf) while the buyer must repay the loan in Equated Monthly Instalments (EMIs) over a specific tenure at a specific interest rate.

We offer funding for comprehensive package insurance product which offers protection to individuals like Permanent Total Disability, Accidental Death and accidental hospitalization etc. And today, owing a car is no longer a luxury, but a comfort that is within one’s reach with attractive car loan facility. Remember, paying upfront in cash could put you under the Income-tax department’s radar, more so after demonetisation. So, bring in the joy and comfort that your family is yearning for. It is more of an emotional decision and a financial, as against in the US it is a commoditized decision.

To keep getting amount in future, please drop a renewal request at A rent buyout advance is a reasonable alternative for those borrowers who are not going to have the capacity to purchase out the rest of the sum on their auto . Here, a business loan specialist will pay out the rest of the adjust on their rent. From that point forward, the borrower should make normal installments to the loan specialist.

Car financing is generally utilized both by individuals from people in general and organizations. Business contract procure, which can give duty and income advantages, is exceptionally prevalent among organizations. OR Customer having satisfactory deposit account with average balance of Rs. 50,000/- & above and banking with us for at least one year.

What personal loan means?

A personal loan (also known as a consumer loan) describes any situation in which an individual borrows money for personal need, including making investments in a company. All personal loans have three common elements: Evidence of the debt (promissory note) An amount borrowed (principal)