betcasino2

How Hedge Funds Optimize Betting Strategies

How Hedge Funds Optimize Betting Strategies

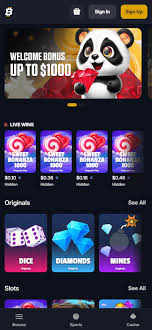

In the ever-evolving landscape of finance and gambling, hedge funds have carved out a niche in betting strategies. By applying rigorous analytic techniques, they are transforming how betting is approached. This includes the integration of statistical models, machine learning, and advanced data analytics. Moreover, these funds have started to leverage platforms such as How Hedge Funds Analyze Betting Markets https://bitfortune-betting.com/app/, which offer tools that enhance their betting efficiency and effectiveness.

The Intersection of Finance and Betting

The convergence of finance and betting is not a new phenomenon, but the role of hedge funds in this arena has captured attention in recent years. Hedge funds have traditionally been seen as entities that focus on stocks, bonds, and other traditional investment vehicles. However, some have ventured into betting markets, applying the same analytical rigor as they would with financial assets.

Understanding Market Inefficiencies

One of the primary strategies employed by hedge funds in betting is the identification and exploitation of market inefficiencies. In both financial markets and betting, inefficiencies represent opportunities where the odds do not accurately reflect the true likelihood of an event occurring. This can arise due to a variety of factors, including public sentiment, misinformation, or simply the natural volatility of markets.

Hedge funds utilize statistical analysis to uncover these inefficiencies. They employ complex models that incorporate a vast array of variables, including historical performance, player statistics, weather conditions, and more. By analyzing these data points, hedge funds can develop a clearer picture of probable outcomes, allowing them to place strategically advantageous bets.

The Role of Data in Modern Betting

Data has become the lifeblood of modern betting strategies. Advanced data analytics allow hedge funds to extract actionable insights from large datasets. Techniques such as machine learning and artificial intelligence play a significant role in this process. For instance, predictive algorithms can analyze past performances and outcomes, identifying patterns that may not be immediately obvious to human analysts.

Additionally, the rise of live betting has opened new avenues for hedge funds. They can leverage real-time data to adjust their strategies dynamically. By continuously evaluating odds and outcomes as events unfold, they can capitalize on fleeting market inefficiencies that arise during games or matches.

Quantitative Models and Betting Strategies

Hedge funds are known for their quantitative approaches, which rely on mathematical models to make predictions and guide decision-making. These models can range from simple calculations of expected returns to complex simulations that account for numerous variables and their interactions.

One widely used model in betting is the Kelly Criterion, which helps determine the optimal size of a series of bets to maximize logarithmic utility. By balancing risk and reward, hedge funds can manage their bankrolls effectively while pursuing high-stakes betting opportunities.

Furthermore, some hedge funds employ Monte Carlo simulations to predict outcomes over numerous iterations, allowing them to assess the probability of various scenarios. This probabilistic approach to betting helps hedge funds refine their strategies and improve their odds of success.

The Importance of Risk Management

Risk management is a critical component of hedge fund operations, particularly in the betting realm where stakes can be exceptionally high. Hedge funds utilize a range of risk management techniques to protect their capital while pursuing aggressive betting strategies. This can include diversifying their bets across different sports, leagues, or betting types to mitigate potential losses.

Another technique involves setting strict limits on the amounts staked on any single bet, which helps avoid catastrophic losses. Hedge funds may also employ hedging strategies, placing opposing bets to ensure a safety net while still potentially profiting from the initial wager.

The Psychological Aspect of Betting

While data and algorithms play a substantial role, the psychological aspect of betting cannot be overlooked. Hedge fund managers must contend with human emotions, not only in their own decision-making but also in the behavior of the betting public. Understanding how markets react to news, player performance, and other stimuli is crucial for anticipating market movements.

By analyzing betting patterns, hedge funds can gain insights into public sentiment and capitalize on irrational behavior. For instance, if the betting public heavily favors a particular team due to recent performances, hedge funds might spot this bias and bet against the crowd, leveraging their analysis of true odds.

The Future of Hedge Fund Betting

The future of hedge funds in the betting world looks promising as technology and data analytics continue to advance. The integration of blockchain technology could further revolutionize the betting landscape by enhancing transparency and security. As more data becomes available and analytical techniques improve, hedge funds will continue to refine their strategies, seeking to stay ahead in this competitive environment.

Conclusion

As hedge funds venture deeper into the realm of betting, their analytical rigor and financial acumen are reshaping traditional betting strategies. By utilizing advanced data analytics, quantitative models, and effective risk management techniques, these funds are not only enhancing their betting strategies but also elevating the industry as a whole. As technology evolves, hedge funds are poised to remain at the forefront of betting innovation, continually finding ways to optimize their approaches and improve their chances of success in this dynamic arena.