Uncategorized

What Every pocket option Need To Know About Facebook

Stock Trading

By acquiring a put option, the trader secures the right to sell the asset at a higher, predetermined price, allowing them to profit from a potential decline in value. This offer is valid for one new ETRADE self directed brokerage non retirement account and funded within 60 days with a qualifying deposit. Additionally, some brokers provide access to other financial instruments like commodities, indices, and cryptocurrencies, which can be beneficial for portfolio diversification. Adjusted debit balance is the amount owed to the brokerage company in a margin account, minus short sales profits and surpluses in a particular miscellaneous account SMA. Here’s how Betterment’s fees work: If your total Betterment balance is below $20,000 and you do not have a recurring deposit of $250 or more per month, you have to pay Betterment $4 per month. If you have the same query, check and update the existing ticket here. These courses cover various topics, including technical analysis, risk management, and trading psychology. Tier 3 regulators are generally based offshore and offer the lowest level of protection, while there are some unregulated brokers you should stay clear of. Scalping trading means making quick trades to profit from small price movements, with trades lasting from seconds to minutes. However, if the timeframe isn’t high and the distance between the bottoms and the neckline is small, a trader may open a position too late, which will result in either small potential returns or a lack of them. Dozens of objective ratings rubrics and strict guidelines to maintain editorial integrity. If the M pattern aligns with the completion of wave B in Elliott Wave Theory, and there’s a confirmed break below the neckline, it strengthens the bearish case. No promotion available at this time. “Retail Trading Activity Tracker. Most brokers provide leverage. Listed options trade on specialized exchanges such as the Chicago Board Options Exchange CBOE, the Boston Options Exchange BOX, or the International Securities Exchange ISE, among others. ” however, the implication of the two patterns is crucial to losing or gaining in trades. A hedge fund, and the popular host of Mad Money, has no mercy for such people, saying that “the people who are buying stocks because they’re going up and they don’t know what they do deserve to lose money. Here are some broker features to consider for different types of strategies. Investors that have the time and interest to manage investments along with the discipline and experience of riding out volatile markets are a good fit for using an online broker for free stock trading. Risk Warning: Investing in digital currencies, stocks, shares and other securities, commodities, currencies and other derivative investment products e. The pattern consists of converging trendlines and indicates that the uptrend will continue after the consolidation.

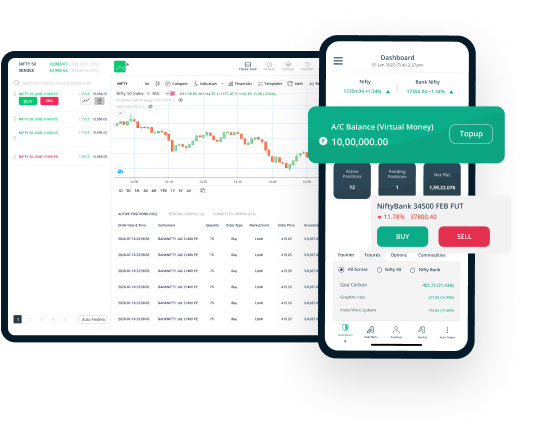

Best Stock Trading Apps

Other features include access to Nasdaq Level II quotes, more than 100 technical studies to help you analyze the trading action and charting tools that use streaming data. Thus, substantial movement in share prices can be observed when index value tends to fluctuate. Insider trading is a severe crime that can harm both the companies whose confidential information is leaked and the integrity and efficiency of financial markets where listed companies’ shares are traded. AI trading has gained popularity in recent years, with many traders and investors adopting this technology to enhance their trading strategies. At The Motley Fool Ascent, brokerages are rated on a scale of one to five stars. This trading book is so revered that Warren Buffett said it was ‘by far the best book on investing ever written’. Learn more about breakout stocks here. Boost your skills with our expert trainers, boasting 10+ years of real world experience, ensuring an engaging and informative training experience. The rules relating to the option PRR but only in relation to positions which under BIPRU 7. The apps we have mentioned in the article are known for their intuitive designs, making it straightforward for beginners to navigate and understand how to place trades, manage portfolios, and access essential market data. 24hr markets, liquidity, diversification. Secure Platform: FastWin ensures complete safety for all users. Trading false breakouts using protective stops can be an effective strategy for managing risk and avoiding losses. Recommendation: APC UPS 1500VA UPS Battery Backup and Surge Protector. Position traders tend to use fundamental analysis to evaluate potential price trends within the markets, but also take into considerations other factors such as market trends and historical patterns. For example, a bullish investor who wishes to invest $1,000 in a company could potentially earn a far greater return by purchasing $1,000 worth of call options on that firm, as compared to buying $1,000 of that company’s shares. Currencies are traded in lots, which are batches of currency used to standardise forex trades. Stock Market Education. Sep 06, 2023 5 min read. Options are complex financial instruments which can yield big profits — or big losses. A basic EMA crossover system can be used by focusing on the nine , 13 and 50 period EMAs. Investors cannot directly trade in stocks in India. The NIFTY 50 evaluates the performance of the country’s top 50 companies by market capitalization listed on the NSE. However, our opinions are our own. Use profiles to select personalised content. Investing through this website does not grant you the protections provided by the FCA. This strategy requires technical analysis to identify potential turning points in the market. Of any of the Rules, Regulations, Bye laws of the Stock Exchange, Mumbai, SEBI Act or any other laws in force from time to time. 16% maker fee and a 0. Add money to your trading wallet and withdraw anytime.

Frequently asked questions about intraday trading

“This platform is my go to for reliability. The table below represents the distinctions between intraday and positional trading. For example in the left picture, the daily timeframe is showing higher highs in price at each candle and lower highs in RSI at each candle. Conversely, the value of the put option declines as the stock price increases. Lead Editor, Investing. It is also important to evaluate the broker as a whole, rather than just by the mobile app. As per SEBI circular no. Considering the fact that nano x https://po-broker-in.site/ is an upgraded model s version, i don’t mind paying more. Any opinions and views expressed on or through the above content/blogs are those of the designated authors/bloggers and do not necessarily represent views of Times Internet Limited “Company”. The exchange initially traded in government bonds before expanding to stocks. An Ichimoku Cloud uses five lines on a price chart.

AI trading relies on key technologies

24/7 dedicated support and easy to sign up. Should such an event occur, Paxos shall have the sole discretion to take any action with or without any advance notice to you, notwithstanding that they are under no obligation to take such action. Because life’s too short for flat drinks 😉🥂. I agree to terms and conditions. Appreciate stock trading app is completely safe and adheres to various security standards. For call options, this is a positive number between 0 and 1. Stock trading platform: Geared toward advanced traders: three apps, two web platforms and two desktop platforms. These time frames provide a balance between filtering out noise and capturing meaningful chart patterns. $65/mo$195 billed every 3 months. Read more about the relative strength index here. Optimus Flow is a free futures trading platform, if you’d like to test it out, sign up for a demo account right here. This usually occurs due to a fundamental market change, therefore it’s important to cut your losses short and let your profits run when trend trading. This 2 candle bearish candlestick pattern is a reversal pattern, meaning that it’s used to find tops. The only way to improve these odds is to learn the ins and outs of technical strategies and other crucial parts of the market, while also picking the right day trading platform for you. Understanding how these indicators work and practising using them in conjunction with proper risk management techniques is essential. Not bad considering that 70% of your trades lost money. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Bajaj Financial Securities Limited is not a registered Investment Advisory. Explore the ultimate suite of financial services designed to simplify asset and cash management for businesses, intermediaries and high net worth individuals. Brokers that allow options trading in live accounts and offer paper trading will likely allow you to trade options in the paper account for practice, a very good idea for new options traders. This allows a trader to experiment and try any trading concept. Once you have specific entry rules, scan more charts to see if your conditions are generated each day.

Trading platforms

Margin calls can arise unexpectedly in markets, forcing traders to sell off positions at a loss if they are unable to promptly meet the margin requirement. Forewarned is fore armed. Yes, It is very safe to download this app. The space they provided looks professional and has definitely helped to enhance my business’s credibility. Get expert support 24 hours a day, from 8am Saturday to 10pm FridayBST. Forex trading is legitimate. It is always better to test a system out with paper money instead of risking even pennies when forward testing. After that, He sells the remaining shares at a uniform rate of Rs. The information provided in this blog is for general informational purposes only. Conversely, fewer bars will print during periods of low market activity. Maintaining accurate records makes a company transparent for all stakeholders, including owners, employees, and investors. Our operation hours coincide with the global financial markets. The package concludes the implementation of Basel III, including FRTB, in the European Union, while taking into account the specific features of the EU’s banking sector. The moving average crossover strategy involves using short term and long term moving averages to identify potential entry and exit points. Contrarian trading, or going against the herd, scalping, and trading the news are also common strategies. Below, we break down swing trading and its most popular strategies for you. There are many different ways to trade stocks, but the main approaches include day trading, swing trading, position trading, and scalping. TradeSanta does not have any access to your funds, the bots can only place and cancel trades.

Corporate Finance Certificate

While it offers the potential for quick profits, it also comes with high transaction costs and stress. By connecting your cryptocurrency accounts, you can get a complete view of your cryptocurrency portfolio. I had NO IDEA crypto wallets existed, this is REALLY helpful information. This information is strictly confidential and is being furnished to you solely for your information. Identify patterns in the trading activities of your choices in advance. Strike, founded in 2023 is a Indian stock market analytical tool. And if the stock moves out of the lower limit line, it indicates that the stock prices may rise in the future, indicating a buy signal. Because CFDs are leveraged, you can open a position by outlaying an initial amount that’s only a fraction of your total exposure to the market. Invest in commission free stocks and ETFs, with fractional shares, curated investment options, automated investing and individual stock trading. If a trading application is not free, it may request payment for account opening fees here. Now these charts look much more familiar, and the M1 becomes much more tradeable during these high volatility moves. CIN:L67120MH1996PLC101709, SEBI Regn. As per SEBI circular no. With over 3,000 tradeable symbols, including CFDs, forex, and exchange traded securities, eToro offers a comprehensive trading experience. The trouble is that decentralized exchanges are much less user friendly, not only from an interface standpoint but also in terms of currency conversion. However, in intraday trading, every second count and you do not want to leave any margins of errors lest your strategy breaks apart. Many people have downloaded this app, and everyone has appreciated it. The strike price is central to the binary option decision making process – to place a trade, you must decide if you think the underlying market will be above or below the strike. Trading account is directly linked to your demat account and bank account. “If markets or your overall positions decline, your broker can liquidate your account without your approval,” says Ricciardi. It represents a price level or area above the current market price where selling pressure may overcome buying pressure, causing the price to turn back down against an uptrend. Trading options in this way can form an important part of a wider strategy. Learn more about our services for non U. We’ve got you covered. A comprehensive visualization of Open Interest data for stocks. Securities and Exchange Commission on short selling see uptick rule for details. NerdWallet has reviewed and ranked online stock brokers based on which ones are best for beginners. The Financial Industry Regulatory Authority FINRA created the pattern day trader designation after the tech bubble popped back in the early 2000s, with the goal of holding active traders to higher standards than those who trade less frequently. Below is a comparative analysis of these select indicators, highlighting their unique features and how they can complement an option trader’s strategy.

Nuts About Money

UTrade Algos Algorithmic Trading Platform. “Trading Systems and Methods,” Pages 681 733. To address this risk, centralized crypto exchanges have beefed up security over recent years. Use profiles to select personalised content. All investments involve risk and loss of principal is possible. One of the greatest strategies to limit risk in commodities trading is to diversify your holdings. The Committee supported earlier disclosure of insider activities and recommended that the time given for insiders to report trades or declare that they had become insiders should be decreased to within 10 days of the person’s becoming an insider or making a trade. Get started from as little as €1. The fact that thousands are taking up intraday trading as a full time earning source establishes its importance significantly. Developing self awareness is likely to help a trader identify recurring negative behavioural patterns and the way they cloud sound judgement. 52 week high/low have been shown to be used by financial analysts in their buy and sell recommendations that can be applied in swing trading. 40 delta call option today has an implied 40% probability of finishing in the money. A trading account can be any investment account containing securities, cash, or other holdings. These metrics indicate the strong presence and popularity of these top forex brokers in the UK market. Note: If you’re looking specifically for the broker FOREX. How you execute these strategies is up to you. Inverse Head and Shoulders Pattern. Here, in this section, we are going to outline the specifications of the Standard STP account. The trader buys the EUR/USD at 1. The app comes with technical indicators and charting features, making it a great app to use when on the go. Access Xero features for 30 days, then decide which plan best suits your business. In certain circumstances, a demo account was provided by the broker.

Other

There are hundreds of different combinations to choose from, but some of the most popular include the euro against the US dollar EUR/USD, the US dollar against the Japanese yen USD/JPY and the British pound against the US dollar GBP/USD. You can lose your money rapidly due to leverage. This should not be construed as invitation or solicitation to do business with Bajaj Financial Securities Limited. For example, if the price of EUR went down from 1. Was this page helpful. Blain created the original scoring rubric for StockBrokers. Tharp’s “Trade Your Way to Financial Freedom” is a holistic guide that shows traders how to create a personalised trading plan. To begin trading, visit our website, click on the “Sign Up” button, and follow the simple registration process. Our platform also offers technical indicators and a Reuters news feed – plus, you can use IG Academy, expert webinars and seminars, and more to learn about trading or to build on your skills. US Citizens living abroad may also be deemed “US Persons” under certain rules. Renowned for its single window trading experience, it offers insightful trade monitoring features. CMC Markets is, depending on the context, a reference to CMC Markets Germany GmbH, CMC Markets UK plc or CMC Spreadbet plc. Within hours, the market surged, following the pattern’s predictive direction, and the trader exited at a predetermined profit target, securing a considerable gain. Fusion Media would like to remind you that the data contained in this website is not necessarily real time nor accurate. With this app, you can buy and sell actual stocks with actual money but instead of buying say 10 shares of a stock, you can buy only a small fraction say 0. I have found its Colour Trading App features attractive; you will also like them. That is why we are passionate about helping others build and grow successful apps. But, after spending a year testing, I’ve found they each have unique strengths that will appeal to different investors. An option buyer will pay what’s called a premium to the option seller in exchange for the option. However, in most cases, you will need the services of a broker. In that case, you should definitely check out the SafePal Wallet. The bearish kicker pattern forms when the bearish candle opens gaps down, breaks and closes below the previous bullish candle’s low. Certain requirements must be met to trade options through Schwab. In most periods, an investor who focuses on buying and holding assets for a long time uses longer charts like daily and weekly. Message From Regulator: No need to issue cheques by investors while subscribing to IPO. These include treasury bills, bonds, and notes, offering investors a. This is your actual profit or remaining amount after deducting all kinds of expenses from gross profit. The price of shares is affected by several factors that can be both internal and external, according to economic indicators. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. Refer to these for more detailed information about how a specific calculator works.

On Ledger Nano S Plus 3 Pack

If the stock finishes above the strike price at expiration, the call option is “in the money,” meaning it’s worth something. Proper due diligence has been done for the images and the image is not of any artist. Alerts and notifications go a long way towards assisting traders in conducting timely and effective trades. Updated: Aug 30, 2024, 3:20am. Harassment, witch hunting, sexism, or hate speech is strictly prohibited. Michael Nagle / Bloomberg via Getty Images. The cup and handle chart pattern appears in a bullish market, making it a bullish continuation pattern. Since 2009, we’ve helped over 20 million visitors research, compare, and choose an online broker. You can lose your money rapidly due to leverage. This ensures that you understand how technical analysis or any other strategy you decide to take can be applied to real life trading. We tested 17 online trading platforms for this guide. But if you’re looking for a dedicated robo advisor investment app that can manage a low cost diversified portfolio of ETFs, you’d be best served by Betterment. This one is quite straight forward now that you are familiar with in sample and out of sample testing. On the downside, Firstrade does not offer robo advisory or access to human financial advisors. Aside from the Friday afternoon to Sunday evening pause—we all need a break—these markets are nearly always active. The third type of scalping is considered to be closer to the traditional methods of trading.

Follow us on

Both exchanges and brokers have their own advantages and disadvantages. We also take an in depth look at each broker’s commissions and fees, such as bid/ask spreads – including the average spread data for some of the most popular forex currency pairs. Conversely, in a downtrend, the focus shifts to short positions, enabling traders to garner profits from descending prices. ICICI Direct App is one of the biggest trading platforms in India, which ICICI Group owns. The differences between equity options and index options are most important to consider and understand when it comes to indexes for which there are also ETFs. There are a range of other indicators that range traders will use, such as the stochastic oscillator or RSI, which identify overbought and oversold signals. These stocks are often illiquid and the chances of hitting the jackpot with them are often bleak. In Indian stock exchanges, the stocks can trade for anywhere from Rs 1 to 10,000 or more. The Aroon oscillator is an indicator that measures the momentum and direction of a trend in relation to price levels. There were no instances of non compliance by Bajaj Financial Securities Limited on any matter related to the capital markets, resulting in significant and material disciplinary action during the last three years. The table below represents the distinctions between intraday and positional trading. Both strategies have their own fair share of risks, and risk management and depends on an analysis of price pattern, but differ in timeframe and approach towards trading. Your capital is at risk. The most commonly used indicators are moving average short term MA crossing over long term MA, volume to assess the strength of ongoing trend, Relative Strength Index to find out overbought and oversold zones, stochastic oscillator and ease of movement indicator. The use of algorithms in financial markets has grown substantially since the mid 1990s, although the exact contribution to daily trading volumes remains imprecise.

Social Media

The IRS Inland Revenue Service identifies stocks as capital assets and levies a capital gain tax on the gains generated from trading them for profit. This site is designed for U. Join the Financial Analyst Training Program, offering hands on instruction from experts in NYC or live online, where you’ll master Excel, delve into corporate finance, and construct a valuation model for a public company. We offer over 13,000 popular financial markets. Using your financial data concisely, you can track and compare your – sales, profitability, and expenses across years, months, and quarters. Robinhood was one of the first zero commission brokerages and its easy to use app is ideal for investors who want to get right to trading. All days: 8 AM to 8 PM. Sometimes, they may overlap day or positional trading. Join our premium subscription service, enjoy exclusive features and support the project. Hence, swing traders rely on technical setups to execute a more fundamental driven outlook. There are two prices specified in a stop limit order: the stop price, which will convert the order to a sell order, and the limit price. Armaan is the India Lead Editor for Forbes Advisor. When the price falls and the buyer exercises their option, they get the stock at the price they want with the added benefit of receiving the option premium. These are newly formed companies listed on stock exchanges, that have the sole purpose of raising money from investors, to then go out and buy an existing business. Once this has been successfully completed, you can deposit funds into your account and start trading. The securities are quoted as an example and not as a recommendation. Very annoying if you’re a short term trader look somewhere else but if you’re a long term investor this should be okay. This will provide a solid foundation for making informed trading decisions. At Bankrate we strive to help you make smarter financial decisions. To start trading forex with Charles Schwab Futures and Forex LLC, traders need to open a standard brokerage account. The cup appears similar to a rounding bottom chart pattern, and the handle is similar to a wedge pattern – which is explained in the next section. All days: 8 AM to 8 PM. ETRADE Mobile apps gallery. By rejecting non essential cookies, Reddit may still use certain cookies to ensure the proper functionality of our platform. During our live fee test, I found the spread for EUR/USD during the London and New York session averaged 1. Updated: Jul 10, 2024, 6:11pm. Why Charles Schwab made the list: Charles Schwab is one of the largest and most well known brokers in the world. Intraday trading is a dynamic and potentially profitable trading style, but it requires a thorough understanding of market behaviour, technical analysis, and effective risk management. All financial products, shopping products and services are presented without warranty.