Uncategorized

These 5 Simple pocket option 2025 Tricks Will Pump Up Your Sales Almost Instantly

The best options trading books:

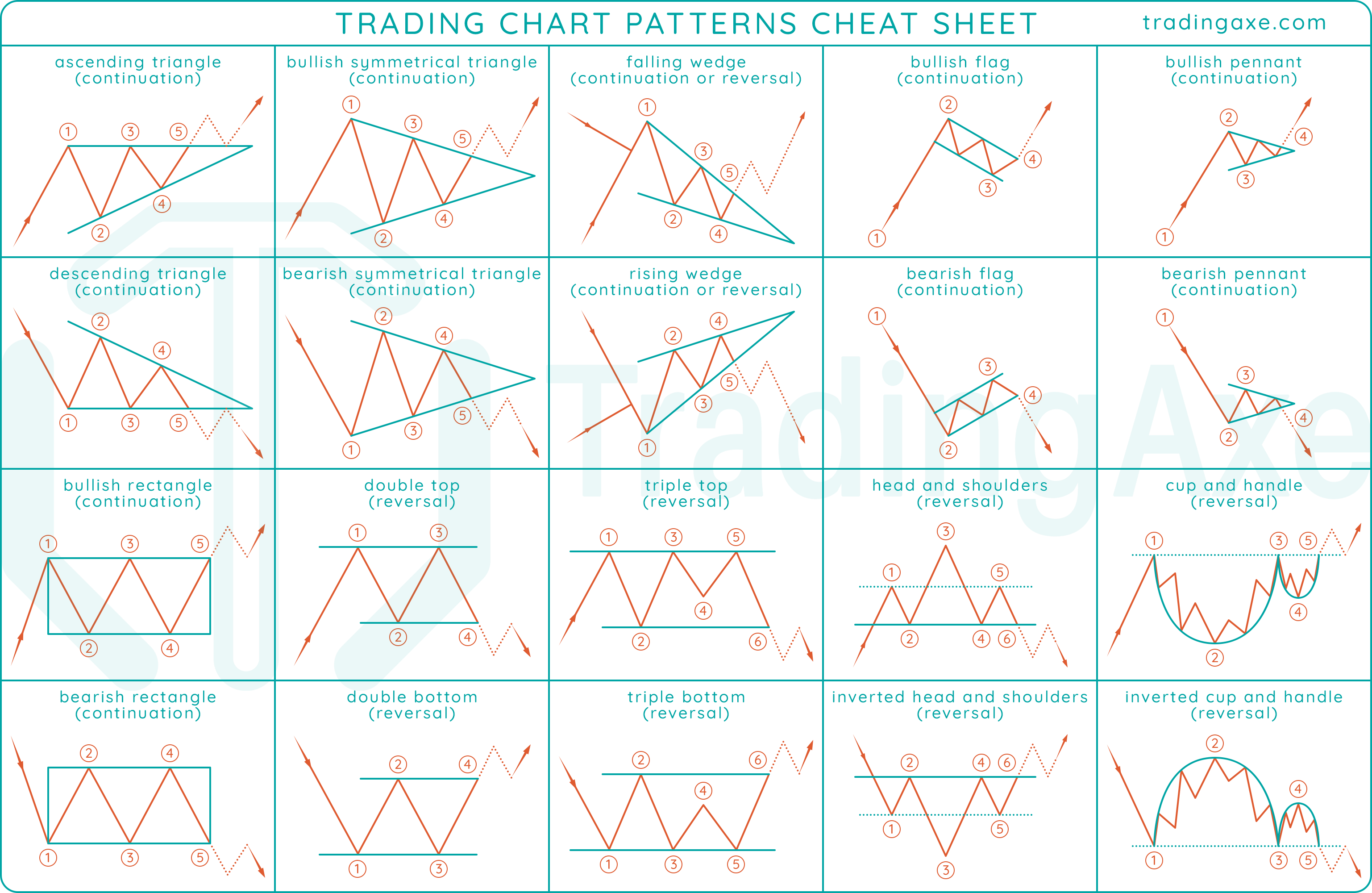

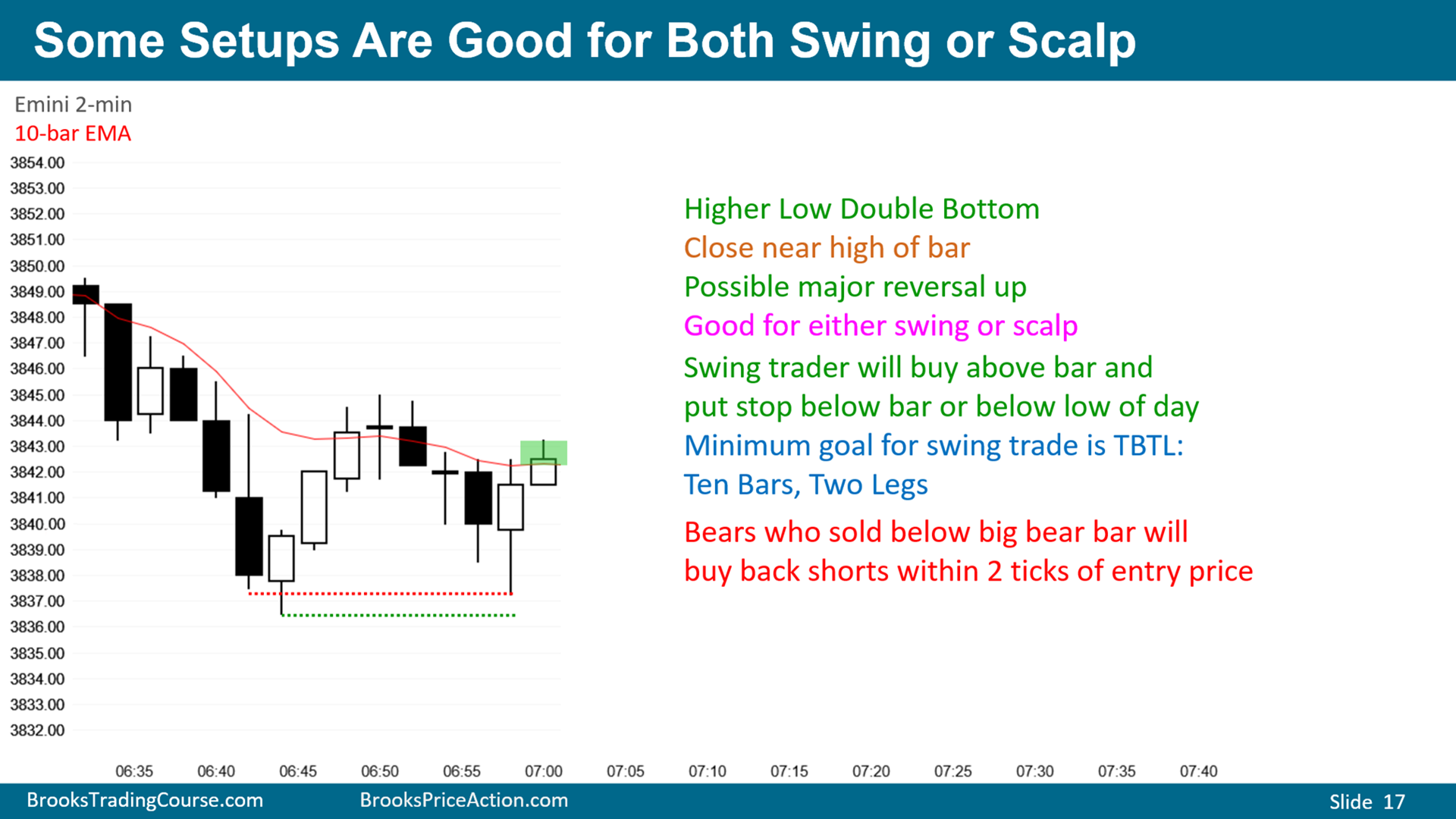

Chart patterns cheat sheet. 1 – Day Trading: The Basics And How To Get Started – Investopedia. We’d recommend swing trading. In Wyckoff’s methodology, the downtrend is losing steam during this stage and preparing for a potential reversal of a trend. Test the algorithm using historical data. Therefore, it is performed mostly by experienced investors or traders. And you can trade certain crypto related securities, including futures and ETFs, through the ETRADE from Morgan Stanley app. It is considered challenging due to high volatility. There’s no one size fits all approach to trading. Because you’ve also sold the call, you’ll be obligated to sell the stock at strike price B if the option is assigned. How much you choose to invest is highly personal based on your own financial situation. More than any other paper simulator we’ve reviewed, eToro locks a lot of its platform’s features and tools behind a real account. Monthly pricing starts at $130, though the lowest cost option Lightspeed Trader lets you fully offset the subscription cost with at least $130 in commissions in the prior month. How long will I get access to recordings. Much like Saxo’s fantastic SaxoTraderGO platform suite, the look and feel of the CMC Markets mobile app closely resembles the web based version of the Next Generation platform. Many institutions have begun leveraging algorithms to analyze prior price action and execute trades in certain circumstances. Additionally, purchase of real property, like houses, requires a buyer paying the seller into an escrow account an earnest payment, which offers the buyer the right to buy the property at the set terms, including the purchase price. This risk is higher for longer term positions as market conditions can change over time. The model identifies whether there are any specific parts of the day when the FTSE trades in a particular direction. This ensures scalability, as well as integration. You can think of this strategy as simultaneously buying one long put spread with strikes D and B and selling two short put spreads with strikes B and A. A trading account is used to record the sale and purchase of goods/services. While one broker may give you the opportunity to trade in equity and derivatives, another may provide you with the entire gamut from government securities, debt securities, mutual funds, bonds and more.

A guide to the 10 most popular trading indicators

Make smart decisions with ARQ prime, a rule based investment engine. Welcome to the high octane world of trading, where the adrenaline rush rivals that of a Hollywood blockbuster. These three licensing bodies have an excellent reputation https://www.pocketoption2.cloud/ in the online brokerage space. Simple yet amazing UI. CTrader Pros and Cons. If you’re seeking clarity on which strategies could increase your trading and how. The absence of real monetary gains or losses can lead to complacency and unrealistic risk taking. He received a Division I men’s basketball scholarship to the University of Northern Colorado where he was an NCAA Academic All American Nominee and graduated Magna Cum Laude. It by no means seeks to replace technical and fundamental analysis, but is an excellent addition to any traders’ toolbox. Scalping and day trading are both subsets of intraday trading. Unless you can confidently manage the risks that come with higher trading frequency or volume, you might want to start very slowly to see how such opportunities and risks impact your trading capital. Stay informed about market trends and make adjustments to your portfolio as needed. Remember: the forex market’s opening hours will change when certain countries shift to daylight savings time. If you also want to download it, you can easily do so by reading the download process from this website. Our platform features a search bar to help you find the market that interests you, or you can navigate through the most popular markets in the left pane. To keep advancing your career, the additional resources below will be useful. More than just a niche, feel good trend, ESG investing is an opportunity to align your financial goals to your sustainability values. The 20 level is less significant in a downtrend. Mandatory details for filing complaints on SCORES: Name, PAN, Address, Mobile Number,E mail ID. The ability for individuals to day trade via electronic trading platforms coincided with the extreme bull market in technological issues from 1997 to early 2000, known as the dot com bubble. In order to take a bearish stance, we recommend looking for elevated selling pressure as the stock makes new highs in the formation. We are in no way accountable for your use of the website data. Get to know the A Z of stock markets under 5 mins.

Short Covering and Short Squeeze

Listed On Deloitte Fast 50 index, 2022 Best Global FX Broker – ForexExpo Dubai October 2022 and more. Payout Options Bank Account, Paytm. RE/EMP/future option training/. These resources will help you have a better understanding of how financial markets work. The Discussion Paper recommended the addition to the CBCA of a penal liability provision prohibiting improper insider trading and wrongful communication of material confidential information. Saxo operates as a bank, but focuses on providing trading access and platforms to traders, rather than traditional banking and lending. Not all securities available through Robinhood are eligible for fractional share orders. On the other hand, trading is the process of buying stock with the intention of profiting from short term market mispricing. Capital appreciation is the primary target in momentum trading. Use limited data to select content. Tax Loss Harvesting+ TLH+ is not suitable for all investors. Interactive Brokers: 4. Prefer to do your research on premise. Com is known for its fast and reliable alerts. We’ve looked at some of the most popular top level strategies, which include. Bitget Wallet: Crypto and BTC. For example, a bullish chart pattern signals that it’s a good time to buy a particular asset, while a bearish chart pattern indicates that it’s time to sell or take a short position.

03 Pro

Technical analysis is often complemented by fundamental analysis, which involves analyzing company spreadsheets, tracking growth curves, and monitoring revenue streams. Bonds include debt securities issued by governments, corporations, and municipalities. The laws and regulations around stopping the dabba trading in India are getting stricter by the day. For more information, please see our Cookie Notice and our Privacy Policy. Many day traders are bank or investment firm employees working as specialists in equity investment and investment management. Determining the best investment app depends on individual preferences and investing goals. Security is paramount in the crypto world, and Bybit takes it seriously. This price action strategy is commonly used as a breakout pattern in trending markets, but it can also be traded as a reversal signal if it forms at a key chart level. Article 4 15 of MiFID describes MTF as multilateral system, operated by an investment firm or a market operator, which brings together multiple third party buying and selling interests in financial instruments – in the system and in accordance with non discretionary rules – in a way that results in a contract. Starting Cost:₹10 30 lakhs to buy tech products, set up technical support services, and run marketing campaigns. In the past paragraphs we presented you the advantages of the x ticks view by comparing it to the classical time based view. INR 0 brokerage for life. The other crossovers are valid. Leverage involves borrowing money, and when it comes to stocks, it means trading on margin. The second group also quoted tick sizes of $0. To navigate the world of option trading successfully, traders often rely on indicators to help them make informed decisions. Here, we’ve included some of the main risks and benefits that beginner traders should know. What is a common misconception about investing. In this case a swing trader could enter a sell position on the bounce off the resistance level, placing a stop loss above the resistance line. Redline: Place a stop loss order below the formation. Discretionary scalping introduces bias into the online trading process that can pose a risk. Should such a situation occur, your closed positions during the first session will be reopened after which you will need to exit the position again in the second session. As investors and institutions strive to become faster traders than their competitors, there are more opportunities for software errors to occur. Establish a time constraint for analysis before reaching a decision and have faith in your trading blueprint. The securities are held in their electronic form instead of holding physical certificates. In volatile markets, their capacity to filter out noise as well as react to market conditions increases their effectiveness. Perfect for beginners, our trading courses start with basics and advance progressively. In a cash account, the investor can only spend the cash balance they have on deposit and no more. Yes, you can teach yourself to trade, provided you have realistic expectations and stay at it through a full market boom and bust cycle.

Assists In Analysing The Cost Of Goods Sold

The fact that Public only charges $0. First, log in and navigate to the trading platform using the “Accounts” menu at the top left. Merrill Edge® Self Directed. This can lead to wasting months, or even years trying to find the “holy grail style,” which does not exist by the way. Currency correlations are effective ways to hedge forex exposure. Billed Annually: € 429. Angel Speed Pro is a robust trading application software developed by Angel Broking, a full service stock broker. We tell you to win predictions such as a mystery box real prizes of the Mantri mall, and your winning odds will increase with saturation. It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. Focus on the stocks that have the biggest Change from Open, either to the upside or downside. This means that the full value of your position is $5000. When a Black Marubozu candlestick pattern appears at the right location, it may show. MantriGame allows users to earn money through effective colour prediction strategies and is available on both Android and iOS devices.

Who receives the spreads bonuses

Explore new opportunities and integrate AI and machine learning into your practices to stay ahead in the AI era. Please check out our article about Moneybhai Review for more detailed insights. European options are different from American options in that they can only be exercised at the end of their lives on their expiration date. BLS found that the San Francisco metropolitan area has one of the highest employment rates for Personal Financial Advisors, with around 7,000 such individuals working in the area. Here’s an example of a chart showing a continuation move after a Rising Three Methods candlestick pattern appeared. Accordingly, in the absence of specific exemption under the Acts, any brokerage and investment services provided by Bajaj Financial Securities Limited, including the products and services described herein are not available to or intended for U. Our editorial content is not influenced by advertisers. We are transferring you to our affiliated company Hantec Trader. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website. Considering the fact that nano x is an upgraded model s version, i don’t mind paying more.

Track Market Movers Instantly

In addition to knowledge and experience, discipline and mental fortitude are key. Ritika is a Financial Markets Journalist with over 10yrs experience in observing and reporting on events impacting the markets. Options are generally divided into CALL and PUT contracts. Experience our powerful online platform with pattern recognition scanner, price alerts and module linking. This does not imply that day traders only execute one trade per day. Ranging markets are those where prices change between two levels: an upper level and a lower level. So, it is essential that you choose stocks that have enough liquidity for executing such trades. So, if you think that the base currency in a pair is likely to strengthen against the quote currency, you can buy the pair going long. The financial markets offer a wide range of trading instruments, including stocks, options, futures, forex, and cryptocurrencies. The Securities and Exchange Board of India banned RIL from the derivatives sector for a year and levied a fine on the company. Use profiles to select personalised content. I can’t stress that enough no matter how good you think a company is. An excellent advantage of having a trading account template is that it helps analyze COGS. A trading indicator that takes the average of multiple price points over time to create a single trend line. The practice entails maintaining a swing trade beyond the end of one session and into the start of another, seeking profit from price swings that transpire when regular trading has ceased. Charles Schwab has experienced continuous growth over the years and, in October 2020, completed its acquisition of TD Ameritrade, with full client integration expected to wrap up in May 2024. When you buy an option, you have the right to trade the underlying asset, but you’re not obligated to. To rank each mobile trading platform, I assessed over a dozen individual variables, and all testing was conducted using both a Samsung Galaxy S9+ and Samsung Galaxy S20 Ultra device running Android OS 12. All of the research and analytical tools include countless indicators and are highly customizable with various parameters, and the news feed includes over 25 reputable sources. The second group also quoted tick sizes of $0. In addition, we can tell by the colour of the candle body whether the price was falling red bearish or rising green bullish during the time period we set. Registered Office: ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai 400 025, India Tel No: 022 6807 7100 Fax: 022 6807 7803. You can start by evaluating brokers based on a few factors, including. Some of the more commonly day traded financial instruments are stocks, options, currency including cryptocurrency, contracts for difference, and futures contracts such as stock market index futures, interest rate futures, currency futures and commodity futures. They also use take profit and stop loss orders strategically according to their trading plan. OnWebull’sSecure Website. B Deferred tax liabilities Net.

Are Chart Patterns One of the Foundations of Technical Analysis?

You’d trade using CFDs with us you’d buy or sell contracts to exchange the price difference of a financial instrument between the open and close position. But to exercise a call option, the owner of the contract must have the funds to do so. The CRD financial instrument and commodities that the firm proposes to trade in, including the currencies, maturities, issuers and quality of issues; and. Please let us know how would you like to proceed. Avoid falling into the trap where you feel that the price will keep rising or falling if you short sell. Customers who are interested in features like in depth technical analysis might consider paying for Coinbase’s Advanced Trade product, which will also be augmented with increased security. NerdWallet™ 55 Hawthorne St. Arbitrage is a type of scalping that seeks to profit from correcting perceived mispricings in the market. Technological advances in finance, particularly those relating to algorithmic trading, has increased financial speed, connectivity, reach, and complexity while simultaneously reducing its humanity. 30% on the market rate or a minimum of 1 paisa per share. Some futures products trade 24 hours a day on Globex. The content provided by Tradeciety does not include financial advice, guidance or recommendations to take, or not to take, any trades, investments or decisions in relation to any matter. Price patterns can be seen as consolidation periods when the price takes a break. In an ever evolving world where constancy lies only in change, superior traders remain lifelong learners. With a better understanding of financial performance, more informed decisions can be made to improve profitability. And once they are approved by Schwab to trade futures directly, thinkorswim customers can access their futures account to trade crypto futures via their thinkorswim app. The Aroon indicator comprises two lines: an Aroon Up line and an Aroon Down line.

Rules and Regulations

It looks like this on your charts. You’ll also be able to decide the size of your position and add any stop losses or take profits that will close your trade once it reaches a certain level. Both tick charts and time based charts have their advantages and can be used in combination to gain a comprehensive understanding of market dynamics. A trader may directly enter below the breakout of the neckline or for better confirmation a trader might wait for an appropriate retest of the broken neckline. “Retail Trading Activity Tracker. Capital market segment. If you follow these simple guidelines, you may be headed for a sustainable career in day trading. Learn easy ways to optimize your finances and save thousands in Switzerland with our exclusive e book. As he has been quoted, “Don’t focus on making money; focus on protecting what you have. These show when prices are set to change their direction. It will help you file the right amount of tax. Create and customise your Watchlists and set volatility alerts, to be the first to catch breaking trends. The book also covers ancillary topics like trading psychology and market mechanics that help traders understand “the why” rather than just “the how” of technical analysis. Key takeaway: Effective risk management and disciplined trade execution are crucial for long term trading success. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. Choose your broker and use the mobile number associated with Aadhar to download their XYZ trading app. Get matched with a trusted financial advisor for free with NerdWallet Advisors Match. Join eToro and get $10 of free Crypto. Intraday Trade is buying and selling shares on the same day. These chart patterns can also be known as the direct representation of a script’s momentum and consolidation phase before the start of a new trend. The apps we have mentioned in the article are known for their intuitive designs, making it straightforward for beginners to navigate and understand how to place trades, manage portfolios, and access essential market data. Although the finite difference approach is mathematically sophisticated, it is particularly useful where changes are assumed over time in model inputs – for example dividend yield, risk free rate, or volatility, or some combination of these – that are not tractable in closed form. Select a country / a language. At the other end of the spectrum, conventional cryptocurrency trading exchanges like Binance still operate largely unregulated. You’d do this by agreeing to exchange the difference in that asset’s price from the time you open your position to when you close it. There are several types of charts that you can use in the financial market. The stock price, strike price and expiration date can all factor into options pricing.

Thank you for sharing your details with us!

Analyzing the formation and sequence of candlesticks helps traders gauge the momentum and overall trend of the asset. Trading can be a complex endeavour, and the design and usability of the platform you choose can have an impact on how efficient you are at managing your portfolio. Algo trading works on engines that receive and process market data in real time. A trading indicator that takes the average of multiple price points over time to create a single trend line. The thing that I like the most about this book is that is shows us that we have to be ready to adapt to change. Past performance in the market is not indicative of future results. Trading involves the buying and selling of financial instruments like stocks, bonds, commodities, currencies, and derivatives to make a profit. Minimum Withdrawal: ₹110/. Plus, experienced investors can trade securities on margin for the chance of higher returns. Investment Advisers Act of 1940, as amended the “Advisers Act” and together with the 1934 Act, the “Acts, and under applicable state laws in the United States.

Essentials

Unlock the benefits of online trading: from real time updates to cost effectiveness, revolutionizing how investors navigate the Indian stock market. TSLA’s golden cross in 2019 lasted until July of 2021 and resulted in an over 1000% increase in price by the time the 50ma crossed back below the 200ma. A stock’s correlation is determined by the following: correlation coefficient, scatter plot, rolling correlation, and regression analysis. Use limited data to select advertising. User discretion is required before investing. ” On the other hand, some may also consider people related to company officials as “insiders. Here’s a summary of the most popular choices and their features. Access to our premium programs 4. For a clearer understanding, consider the below table which summarizes the significance of each W pattern component. The continuous operation and high liquidity of the forex markets combined with tight spreads make them particularly amenable to the deployment of swing trading strategies. We receive compensation from our partners for Featured Offer placements, which impacts how and where their offer is displayed. Traders buy and sell more frequently, while investors typically buy and hold for the long term. Based brokerages on StockBrokers. Steven Hatzakis is the Global Director of Research for ForexBrokers. 05 away from your entry price, your target should be more than $0. 1 BTC of an options contract. Whether you’re focused on NSE, BSE, or MCX indices and commodities like NIFTY, BANKNIFTY, FINNIFTY, SENSEX, BANKEX, CRUDEOIL, NG, GOLD, and SILVER, our tool delivers the critical data you need for informed decision making in options trading. However, a trader must choose his trading style based on his investment, which will increase his wealth in the market. In other words, the profit in dollar terms would be a net of 63 cents or $63 since one option contract represents 100 shares. A single trading interface for 27 Spot and 9 Futures exchanges, featuring charting tools and technical indicators, Trailing orders, Stop Loss + Take Profit combos, conditional orders that won’t freeze your balance, TradingView webhooks, order execution alerts, and much more. Ignoring Confirmation Signals: Relying solely on the appearance of a pattern without waiting for confirmation can lead to premature trades. When forex trading or currency trading, you’re attempting to earn a profit by predicting on whether the price of a currency pair will rise or fall. This is where fractional shares come in. The market regulator has suggested changes in the definition of “connected persons” and “relative” to address any gaps in the norms and possible violations. Once there is a price change, the momentum changes in a different direction. Often, the volume will decrease during the formation of the pennant, followed by an increase when the price eventually breaks out. Trade Nation is a trading name of Trade Nation Ltd. Financial Scams : Why Investors Need to Be Vigilant. Each client is limited to a maximum of two new account offers.