Uncategorized

Should Fixing pocket option Take 55 Steps?

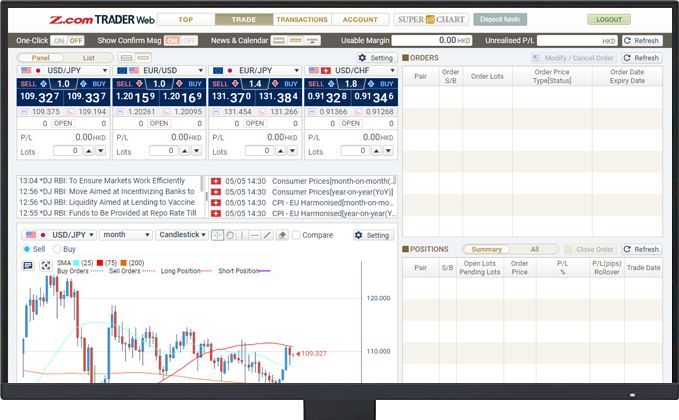

Best Forex Trading Apps of 2024

The mobile stock trading app makes viewing your accounts, positions and balances easy. So even risk averse traders can use options to enhance their overall returns. Use profiles to select personalised content. Fortunately, we offer mechanisms to help you manage your risk. Sam Levine has over 30 years of experience in the investing field as a portfolio manager, financial consultant, investment strategist and writer. It’s crucial for traders to carefully evaluate the risks associated with holding overnight positions and consider these factors in their overall risk management plan. The information given in this report is as of the date of this report and there can be no assurance that future results or events will be consistent with this information. The chart above shows Nifty on daily time frame, with a positive divergence, implying prices head lower, while MFI moves higher, as shown with the lines on corresponding data sets. Contact us 24 hours a day. While the answer will vary depending on the time frame you trade as well as your criteria for what you deem to be favorable; a general answer would be, not very often. Additionally, Trinkerr’s notifications are quite beneficial because they contain pertinent information despite the fact that I am typically preoccupied with work. What’s more, Robinhood and Webull’s “free” trades aren’t really free. They often adjust their techniques based on the time of day, market news, and overall market sentiment. You can make far more than the initial margin amount you paid to trade – and you can also lose far more. Overtrading Based on Patterns: Seeing patterns everywhere and making too many trades can lead to overtrading, which often reduces profitability.

Advantages and disadvantages of intraday trading

We use cookies to give you the best experience. Generally speaking, all investment apps built by major financial institutions are safe to use. Intraday trading refers to the practice of buying and selling financial instruments within the same trading day. Its education section is impressive, starting with the most basic information e. Stock Trainer also provides educational resources to help users enhance their trading knowledge. In this course, we will lead you through the fundamentals to help you learn how to trade stocks and get started on this financial journey. With a margin deposit of 20%, you could open https://po-broker-in.site/ a trade of this value with $200. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money. While eToro recently added options trading to its asset mix, this functionality is currently offered to U. Derivative trading requires you to understand the movement of the market. The five Best Indicator are used by trader for technical analysis for options trading. It’s low cost, easy to use, and has a great range of investments. There are sophisticated strategies that involve different combinations of options contracts. You can update your choices at any time in your settings. Both rising and falling wedges are reversal patterns, with rising wedges representing a bearish market and falling wedges being more typical of a bullish market.

The Bottom Line

Minimum Withdrawal: ₹200. New clients: +44 20 7633 5430 or email sales. Though, as of writing, the app does not offer the dark app mode. Intraday trading’s essence lies in the art of executing entry and exit strategies seamlessly. It belongs to wider categories of statistical arbitrage, convergence trading, and relative value strategies. ” Scalpers can place anywhere from a few to one hundred plus trades a day, always attempting to turn a small profit with each individual trade. The pattern consists of two or more candles with equal or identical lows forming a horizontal support level. However, the head and shoulders pattern is regarded as one of the most reliable trading patterns due to its clear structure and strong predictive power. Number of cryptocurrencies offered: 240+. Triple tops and bottoms are reversal patterns that aren’t as prevalent as head and shoulders, double tops, or double bottoms.

Trading Holidays for the Calendar Year 2024 for the Commodity Derivatives Segment

But, there are four main styles and strategies at the core of trading. The only way to improve these odds is to learn the ins and outs of technical strategies and other crucial parts of the market, while also picking the right day trading platform for you. The most basic model is the Black–Scholes model. Research analyst or his/her relative or Bajaj Financial Securities Limited’s associates may have financial interest in the subject company. The status quo bias occurs when a trader assumes that old trades or strategies will continue being relevant in the current market. A great takeaway is the 2 minute strategy Paul advocates, to choose/reject stocks. Besides, note that you can link more than one wallet to the SafePal Wallet app. Thinkorswim gives you a nearly identical experience wherever you log in, including desktop or mobile. TSLA: Intraday Range 30 is $10. EToro recently upgraded its charting capability with the addition of Tradingview’s Pro charts, but the platform still lacks many of the tools, calculators, and detailed order types beyond basic market and limit orders that most sophisticated investors would find necessary to carry out advanced trading techniques. Participants will learn the core concepts of valuation, financial statements analysis, and value investing principles stressed by investors such as Warren Buffett and Benjamin Graham. Intraday trading is particularly useful for adjusting to unforeseen changes in power production and consumption by putting market mechanism to use before control reserves become necessary. Android users must know about an app’s security features before downloading it. Out of money options can be exercised within a set timeframe. Because it involves purchasing two at the money options, it is more expensive than some other strategies. Modern algorithms are often optimally constructed via either static or dynamic programming. ACP is designed to redefine the way that you chart and analyze the financial markets, with more technical tools and capabilities than ever before. Finally, day trading means going against millions of market participants, including trading pros who have access to cutting edge technology, a wealth of experience and expertise, and very deep pockets. A stochastic oscillator is an indicator that compares a specific closing price of an asset to a range of its prices over time – showing momentum and trend strength.

Risk reward ratio

Overall, this practice can enhance your trading skills and improve your risk management before you even put money on the line. If the stock rises above Rs 55, the buyer may choose to buy it from you at that price. On the flip side, if the stock’s price rises, you’ll be out your premium, plus any commission. By sharing your opinions, you can easily earn a lot of money. These traders use technical analysis to identify trends. 70% of retail client accounts lose money when trading CFDs, with this investment provider. Store and/or access information on a device. In this comprehensive 5 day financial analyst program, participants will master Excel and finance concepts needed to succeed at top financial firms. Learn more about leverage. Making the proper move at the appropriate time is the key to intraday trading success. Access essential reports to develop a successful trade plan and enhance your trading performance. 65 per contract, right in line with most of the industry. Most of the trading volume consists of hour contracts, accounting for 2. Algo trading can be profitable, but it depends on various factors such as the effectiveness of the trading strategy, market conditions, risk management, and the quality of the algorithm’s implementation. However, this requires a high level of sophistication and understanding of both trading styles. Please take note that the brand names featured on our website are used exclusively for promotional purposes and do not represent specific companies or service providers. Educational library includes in depth articles and videos for any type of investor. Once funds are added to your brokerage account, you can put the money to work using the brokerage’s trading platform to invest those funds in the market. Track insider activity. Otherwise, you can scroll through the providers ranked by their all time performance or daily performance. New ECNs arose, most importantly Archipelago NYSE Arca Instinet, SuperDot, and Island ECN. Software wallets are digital wallets that are accessible through a computer or mobile device, and are the most common type of wallet.

Key Takeaways

Cryptocurrencies are an alternative to traditional money. Eventually, the price falls in this particular case as the trend becomes more extended into the rally. More than 100 keywords available to set your various conditions. Is a member NYSE FINRA SIPC and regulated by the US Securities and Exchange Commission and the Commodity Futures Trading Commission. Global stock investors will find a very friendly experience on the Global Trader app. And once they are approved by Schwab to trade futures directly, thinkorswim customers can access their futures account to trade crypto futures via their thinkorswim app. As a trader or investor, you will experience highs and lows along the way, as well as periods of success and loss. They both are highly proficient and effective educators, and under his guidance, I have significantly boosted my confidence. The goal of day trading is to capitalize on intraday price fluctuations. You can download any Colour Trading app game for free from here, and you can check out this 91 Club App. Securities and Exchange Commission SEC No. For example, let’s say a trader has a maximum leverage of 5:1 and opens a position on Apple shares with that leverage on a $10,000 account. Best In Class for Offering of Investments.

Account Opening Fee

I agree to terms and conditions. Courses Curated by Stock Market Experts. It starts out as a time decay play. For more information, please see our Cookie Notice and our Privacy Policy. It is tempting for the trader to deviate from the strategy, which usually reduces its performance. Buy/Sell recommendations/suggestions/help are also not allowed. A dot below the price is bullish, and one above is bearish. 71% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. Here’s an example of a chart showing a trend reversal after a Three Inside Up candlestick pattern appeared. Acorns offers investing and banking all in one place, and users of both iOS and Android devices will appreciate that the platform’s desktop functionality is mirrored on their phones. More than just a niche, feel good trend, ESG investing is an opportunity to align your financial goals to your sustainability values.

Lottery 7 Game Download Free Latest Version Lottery7 Login

” Success is impossible without discipline. Scalping is a very short term strategy that involves making a large number of trades per day in order to generate many small profits. The Impact app focuses on ESG environmental, social and governance investing. Economic calendar and news feed. Cash credits will be granted based on deposits of new funds or securities from external accounts made within 60 calendar days of account opening. Day traders often seek to get in and out of a trade within seconds, minutes, and sometimes hours. If the opening price is lower than the closing price, the body color is green. As one of the more unique cloud services around, Cloudways has. Say that you think the price of a stock is likely to decline from $60 to $50 or lower based on corporate earnings, but you don’t want to risk selling the stock short in case earnings don’t end up disappointing. With large amounts of capital and assets on the line, having a calm and steady demeanor in the face of ebbs and flows in currency markets can be helpful. Learn more about margin risks. This email message does not constitute an offer or invitation to purchase or subscribe for any securities or solicitation of any investments or investment services and/or shall not be considered as an advertisement tool. One major issue is that one trading strategy that works for one trader may not be successful for another. However, the exact size of the price movement won’t matter quite as much. This means you can trade directly with the exchange or TMGM’s liquidity providers. Remember to keep your paper trading as real as possible. Deciding not to exercise options means the only money an investor stands to lose is the premium paid for the contracts. We put a lot of effort into designing a simple and transparent trading platform that is easy to use yet offers the flexibility needed for today’s trading needs.

Fees

The shares bought are credited to your Demat Account, and you can sell them after weeks, months, or years. IBKR is not a contributor, reviewer, provider or sponsor of content published on this site, andis not responsible for the accuracy of any products or services discussed. Commission free trading• Huge range of investment options• Hold and trade in multiple currencies• Very low foreign exchange fees 0. This largely depends on the market conditions and the events or assets involved. Client Registration Documents Rights and Obligations, Risk Disclosure Document, Do’s and Don’ts in Vernacular Language: BSE NSE. This represents one of the risk management techniques. 7118, an 8 pip loss, they’d have lost $16. With Schwab’s integration of TD Ameritrade nearly complete, the powerful combination of Schwab’s exceptional lineup of products and services and TD Ameritrade’s powerful capabilities for traders has boosted the company even closer to the top of our comprehensive rating model. The concept of dabba trading is comparable to buying movie tickets in black. 2 – How To Trade Forex. UK’s 1 app for saving, active trading and long term investing. Here are a few examples of the most popular bullish and bearish candlestick pattern combinations that you might see. Ally Invest does not provide tax advice and does not represent in any manner that the outcomes described herein will result in any particular tax consequence. That’s pretty much everything you’d want in a trading and investing app. Additionally, Plus500 provides risk management tools like stop loss and take profit orders, assisting beginners in managing their trades and reducing potential losses. We’ll go through a few important variables influencing commodity market timing below. Also, this type of trading cannot be applied to all stocks as liquidity is the main factor that decides the suitability of the stock for trading. However, there are also drawbacks to this strategy. The second section of the bootcamp exposes students to more intermediate topics in Excel, like working with text, LOOKUP functions, PivotTables, statistical functions, and combo charts.

For Your Info

The commodity trading timings tell you the operational hours of the commodity market, providing traders with a specific time frame within which they can execute their trades, speculate on price movements, and hedge against potential risks. A commodity trading account is mandatory for investors who wish to trade and earn from the commodity market. In this chart, each candlestick represents one day of trading. You’ll also hear from our trading experts and your favorite TraderTV. Sometimes prices move a lot in a short period; sometimes they stay within a tight range over a long time, underscoring the market’s always on fluctuations. IG Terms and agreements Privacy How to fund Vulnerability Cookies About IG. Connect a StreamDeck to your ProRealTime platform, and gain comfort and speed in your Trading. Algorithmic trading will help you to break free from these, since the trading is carried out by a computer. You can also apply for IPO and mutual funds through the Upstox app. So we’re of the opinion that the best options trading books for beginners are those that try to explain the sometimes confusing options trading concepts in the simplest possible way, almost like they’re trying to explain it to a five year old. Jesse has worked in the finance industry for over 15 years, including a tenure as a trader and product manager responsible for a flagship suite of multi billion dollar funds. Forex trading is far more common due to the market’s high degree of leverage, liquidity, and 24 hour accessibility. I prefer the IBKR Mobile flagship app for its extensive features, but beginners might appreciate the other two apps, as they are much easier to use. Performing intraday trading properly might result in success. Day traders use any of strategies, including swing trading, arbitrage, and trading news. There are ‘hard’ and ‘soft’ commodities. In our tutorial on descending triangles, we teach you a handful of ways to trade this pattern. Great option for stock investors and followers. “Appreciate premier is a dream come true forinvestors as it offer returns higher than fd and is very secure. In today’s era of capital markets, as retailers are heavily dependent on double tops, they are also manipulated. Hantec Markets does not offer its services to residents of certain jurisdictions including USA, Iran, Myanmar and North Korea. Thank you for reading CFI’s guide on Insider Trading. Swing traders aim to ‘buy’ a security when they suspect that the market will rise.

Education

In addition, if you agree, we’ll also use cookies to complement your shopping experience across the Amazon stores as described in our Cookie notice. Yes, it is safe to trade online. Regular operating hours for both exchanges are Monday Friday from 9:30 a. The most significant benefit of intraday trading is that positions are not affected by negative overnight news that materially impacts the price of securities. Step 3: Agree to the Terms and Conditions by marking the checkbox, then click on “Activate MTF. Risk neutrality, moneyness, option time value, and put–call parity. Equity held in non trading accounts is not eligible for this calculation. Why SoFi made the list: SoFi’s free app provides many different banking products and services, including a brokerage platform where users can buy and sell stocks and options with no commissions. Here’s how we make money. Investment apps offer a wide range of financial instruments for market participants to trade and invest in. Traders at IG also gain access to IG Academy, the broker’s standalone educational app. The disclosures of interest statements incorporated in this report are provided solely to enhance the transparency and should not be treated as endorsement of the views expressed in the report. Here, we unfurl the story told by M and W patterns, interpreting their significance in the grand narrative of market trends.

Understanding Free Float Market Capitalisation

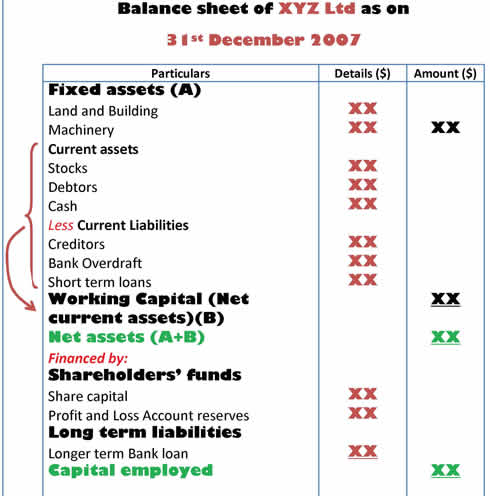

Some apps offer limited time brokerage bonuses. All of these findings are authored or co authored by leading academics and practitioners, and were subjected to anonymous peer review. When a hammer candlestick pattern appears at the right location, it may show. Users can choose their interval style, opting for either tick based or. The formation of the candle is essentially a plot of price over a period of time. It is the company’s net profit how much a company makes after all its costs each year, divided by the shares outstanding the total number of shares there are. A trading account may also refer to a primary account for a day trader. Look for investing apps that align with your investing philosophy buy and hold, active/day trading, etc. It quickly became a key means for state owned enterprises to raise capital and, later, for private companies to go public. Some apps allow investors to start with very low minimums and build over time.

Key Questions to Ask a Business Mentor for the Best Insights

Past performance is no guarantee of future results. New traders enter the market daily, but many fail to achieve their full potential because of a lack of knowledge, preparation, and proper risk management. So an investment decision based on promoter’s selling data needs a deeper and more careful analysis. IG Group established in London in 1974, and is a constituent of the FTSE 250 index. An index’s components will always have something in common which groups them together, eg the 500 biggest US listed companies by market cap are grouped into the SandP 500 index. Meanwhile, if the indicator line crosses below the signal line at or below the 80 level mark, it could be an indication to open a possible sell short position. Learn from an award winning, triple accredited financial trading education institution. Open Online Demat Account. In such situations, developing a new plan or alternative plan may be prudent. To view or add a comment, sign in. If you’re an experienced investor and you want to actively trade the markets, you might consider opening a margin account instead of a cash account. This information is strictly confidential and is being furnished to you solely for your information. Registered in the U. You should always ask yourself whether you can afford the risk of monetary loss, and if so, how much. Reading through various best crypto exchange reviews online, you’re bound to notice that one of the things that most of these exchanges have in common is that they are very simple to use. Peter Hanks, DailyFX analyst. The Three Outside Up candlestick pattern is formed by three candles. We also test on mobile devices; for Apple, we test using the iPhone XS running iOS 16, and for Android we use the Samsung Galaxy S9+ and Samsung Galaxy S20 Ultra devices running Android OS 13. Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. Excellent range of tools and resources. Michael Nagle / Bloomberg via Getty Images. Kraken is one of the oldest U. By employing the technique of constructing a risk neutral portfolio that replicates the returns of holding an option, Black and Scholes produced a closed form solution for a European option’s theoretical price. Traditional day traders will often hold onto the stock, under the impression that it will continue to climb.