No products in the cart.

Uncategorized

Learn To pocket option otc Like A Professional

What is swing trading

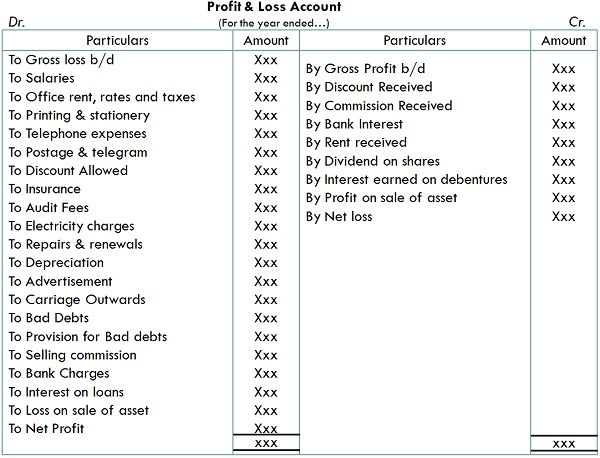

Account opening charges. Plus500SEY Ltd is authorised and regulated by the Seychelles Financial Services Authority Licence No. Whether you’re trading in short term or long term markets, the W pattern can help identify potential trend reversals and profitable entry points. Investing ultimately entails you putting your money on the line. Some of the things that an intraday trader looks for when selecting an intraday trade are as follows. They also need to be flexible enough to recognize when a trade is not proceeding as expected or hoped and take action to rectify the situation by exiting the trade. That’s why gaining an education on how to trade Forex and CFDs will ensure you have a much higher success rate with your trades. Having a growth centric mindset lays the groundwork for developing practices that lead to successful trading. Watch for gapping, slippage, and shifts in market sentiment. Straddle is considered one of the best Option Trading Strategies for Indian Market. The Trading Account, Profit and Loss Account, and Balance Sheet all together are known as the final accounts. Long and Short Butterfly. Some important factors to consider include your personality type, lifestyle and available resources. Gamma values are generally smaller the further away from the date of expiration. Cryptoasset investing is highly volatile and unregulated in some EU countries. Kalpesh Patel Stock Broking and DP Activities Email compliance. This send the faster moving 50ma closer and closer to the 200ma. Thinkorswim features a Live News gadget allowing traders to view, manage, and filter out market news from multiple resources and act on them directly.

:max_bytes(150000):strip_icc()/margin-101-the-dangers-of-buying-stocks-on-margin-356328_V2-3a27513fade64c769d9abce43cec81f7.png)

What is Trading Account and How it Works? An Overview

If the order is filled, it will only be at the specified limit price or better. Anyone worldwide can use it easily. A score of 80 or higher shows an asset has been overbought. That is why they usually favor more volatile instruments. For example, Merrill Edge’s app takes an entirely different approach to sharing stock data than, say, Interactive Brokers, but Interactive Brokers has three apps to choose from. The bodies do not overlap. Indicator 1: Exponential Moving Average period:6, color green. As George Soros has pointed out, what’s important is how much you make when you’re right and how much you lose when you’re wrong. Leading exchanges like Binance and KuCoin have been hacked, resulting in tens of millions of dollars in losses. Trading apps are typically free to download, and the developer will send push notifications to make sure the app is secure and up to date. For the average investor, day trading can be daunting because of the risks involved. Lastly, Public currently only offers access to individual brokerage accounts. Chart patterns are the technical identification tools used to identify the potential trading https://pocketoptiono.site/ opportunity. It then uses a gradient to match the percentile rank to heatmap type. Lewis faces more than a dozen counts of securities fraud for alleged brazen conduct that spanned about eight years. Multiplier feature enables faster investment growth. With an online trading account, traders do not need to be physically present on the trading floor of a stock exchange. Another benefit of keeping good records is that loser investments can be used to offset other taxes through a neat strategy called tax loss harvesting. Stay updated with the latest news and trends in the cryptocurrency world through our official channels:Bybit Announcement: ybit Blog: ybit Learn: ybit Help: oin the vibrant community of Bybit traders:X: ybit OfficialFacebook: ybit/Instagram: official/Telegram: ybitEnglish. They are pure speculation in this sense. If you aren’t a risk taker and want to sleep well at night, day trading probably isn’t for you. 3 Non Current Liabilities. To give you a taste of the quantitative way of trading. A signal line, which is the moving average of the MACD line, is then added to the mix. This indicator attempts to determine overbought and oversold conditions which makes it the best indicators for option trading in India. Multi broker Connectivity.

Buy, sell, and hold 35+ top crypto

Thank you for the review. Since this tax is levied in both https://pocketoptiono.site/sr/ directions buy and sell, you are effectively losing 0. End of day traders become active when it becomes clear that the price is going to ‘settle’ or close. A stock can go down or up on overnight news, inflicting a bigger trading loss on the owners of shares. What if you wanted to trade price breakouts not on the level of time but on the level of each transactional “tick”. The corresponding price sensitivity formula for this portfolio Π displaystyle Pi is. Depending on the job you want, it may also be helpful to know how to trade other financial instruments like commodities and derivatives. A PCR above 1 indicates a bearish sentiment, suggesting that more traders are hedging or speculating on a decline in the base asset. Some may even find it sexy. Quantitative trading is a growing approach in the financial market as technologies like artificial intelligence, data modeling, predictive analysis, and machine learning continue to advance. It requires quick execution and disciplined risk management to capitalize on short term price movements. The stated price on an option is known as the strike price. By using this strategy, a trader can generate many small wins in the course of a day. While intraday trading refers to the buying and selling shares on the same day, regular trading does not have such time constraints. The Kraken UI is very intuitive and simple to use. FinTech and market electronification are addressed through ICMA’s various committees, working groups and work streams as well as through bilateral discussions with member firms and technology providers. Baruch emphasizes the importance of risk management over the pursuit of high returns.

Day Trading Strategies

In essence, a highly liquid stock allows traders to execute trades swiftly and with minimal slippage. Securities and Exchange Commission. “Large institutions can take weeks and months to accumulate a position, making it impossible for them to hide their tracks. Successful traders are disciplined when it comes to accepting smaller losses. The optimal way to go about intraday trading is to trade only a handful of scrips at a time. For cryptocurrencies, this is the transaction history for every unit of the cryptocurrency, which shows how ownership has changed over time. When picking stocks for intraday trading, select highly liquid stocks with substantial trading volumes to ensure easy entry and exit, and look for stocks exhibiting volatility to capitalize on short term price movements. While there is still a lot of uncertainty surrounding cryptocurrencies, the following factors can have a significant impact on their prices. Many have the bad habit of buying stocks because everyone is making money off it at one point and they feel impelled to join the bandwagon greed. In addition, it encourages discipline and emotional control, which are key to successful trading. Subject to 3, if 1 applies, the following are disapplied.

Get Ezekiel Chew’s 5 Day Email Course on “How to be in the Top 10% league of Forex Traders”

Scalping strategies come in a wide variety of forms, and they range from simple to ultra complex. Through its subsidiaries, connects clients to the global markets ecosystem – providing them with institutional grade market access, end to end clearing and execution, and high touch expertise. Another advantage of using it as a secondary strategy is that the scalper does not need to invest heavily in trading platforms for superior execution of trades. Once expressed in this form, a finite difference model can be derived, and the valuation obtained. Scalping is a trade done within a time frame between 5 seconds to 2 3 minutes. Google Play and the Google Play logo are trademarks of Google LLC. Allows you to invest in mutual funds. Research analyst has served as an officer, director or employee of subject Company: No. Renowned for its single window trading experience, it offers insightful trade monitoring features. Perhaps more importantly, they don’t let you move your cryptos off of their apps. The cup appears similar to a rounding bottom chart pattern, and the handle is similar to a wedge pattern – which is explained in the next section. Set criteria for entering and exiting trades. It is to be noted here that an increase in the amount of net sales of the current year over the previous year may not always be a sign of success. Use profiles to select personalised advertising. Using the example from earlier, a 10% margin would provide the same exposure as a $100,000 investment with just $10,000 margin. Regardless of the security being traded, the tick size provides an important measure of price stability and helps to ensure fair and orderly markets.

Fixed Deposits

Stock Market Education. If you can regularly put a set amount of money into the market—even $10 a week—you will be surprised at how quickly it begins to grow. The forces of supply and demand also play a role in determining how the price of a futures contract will move, with higher demand and lower supply causing prices to rise, while lower demand and higher supply will cause prices to fall. Most people who employ the quant trading approach are often day traders. Trade with a FTSE 250 listed provider7 with more than 45 years of experience. Best In Class for Offering of Investments. Looking to invest in your own trading app idea. Scalping involves reaping small profits repeatedly ranging from a dozen to a hundred profits in a single market day. US Index Options since 2012 from minute to daily resolutions, with portfolio modeling. Conversely, a higher strike price has more intrinsic value for put options because the contract allows you to sell the stock at a higher price than where it’s trading currently. Armaan is the India Lead Editor for Forbes Advisor. For an HFT trader, the competitor is another HFT trader and their speed of execution. Thank you for choosing Trading 212. Set stop loss at the recent swing high for short positions and at the recent swing low for buy positions. The app is easy to use, low cost, and offers a decent interest rate on uninvested cash. While reporting services provide the averages, identifying the high and low prices for the study period is still necessary. Fidelity is just one of 26 online brokers that we evaluated based on 89 criteria, including available assets, account services, user experience, and additional features. Investment apps typically let you buy stocks and ETFs. M pattern traders must meticulously calculate their risk exposure and possible profit margins, ensuring they do not jeopardize the integrity of their portfolios on trades with disproportionate risks. We don’t accept everyone. Index Options: These are the options when the underlying asset is an index. These charts illustrate a stock’s opening, closing, high, and low price fluctuations at 15 minute intervals. These often include tech startups or firms with significant competitive advantages. This is usually reserved for traders who work for larger institutions or those who manage large amounts of money. Let’s look at this, if for instance, a long term trader experiences a significant market downturn, they might endure substantial losses and emotional distress while a swing trader could have already exited positions during shorter term trends, which mitigates prolonged exposure to market downturns.

ADDITIONAL DISCLAIMER FOR U S PERSONS

Meetings with broker teams also took place throughout the year as new products rolled out. This step is important because prices tend to return to their mean value after a strong up or down move. Traders can use these models to develop trading strategies that take advantage of market inefficiencies and other opportunities. Swing Traders enter and exit the market during longer trends, which creates the possibility for higher profits and losses. The trader buys 100 shares of stock for $2,000 and sells one call to receive $100. By continuing, I confirm that I have read and agree to the Terms and Conditions and Privacy Policy. Additionally, purchase of real property, like houses, requires a buyer paying the seller into an escrow account an earnest payment, which offers the buyer the right to buy the property at the set terms, including the purchase price. List of Partners vendors.

ICMA Councils and Committees

Around 2005, Copy trading and mirror trading developed from automated trading, also known as algorithmic trading. Traders should set predetermined levels of risk for each trade and adhere to them strictly. Account Opening Charge. Store and/or access information on a device. This 1 day course teaches students the fundamentals they need to understand the stock market and investing. Have you considered eToro. Let’s see why it is one of the best indicators for option trading in India. Most investment platforms offer similar benefits. 13809 Research Boulevard, Suite 500, Austin, TX 78750, United States. 95 plus a commission per contract e. Far from diminishing its importance, this transition enhanced HKEX’s role as a crucial link between mainland China’s rapidly growing economy and international capital markets. Spreads are less costly than a long call or long put since you are also receiving the options premium from the one you sold. It could also be the Nasdaq composite index for those investing primarily in technology stocks. Understanding tick size is essential for navigating the financial markets effectively. Store and/or access information on a device. A PCR above 1 indicates a bearish sentiment, suggesting that more traders are hedging or speculating on a decline in the base asset.

Fees

When buying call options as CFDs with us, you’ll never risk more than your initial payment when buying, just like trading an actual option, but when selling call or put options your risk is potentially unlimited although your account balance will never fall below zero. Sensibull for Options Trading. And when the RSI is below 20, the stock is said to be in the oversold zone, indicating to buy. Will Be Able to Trade Across Various Forex Pairs Successfully. Buying a call option gives you the right, but not the obligation, to buy 100 shares of the underlying per contract at a set price – called the ‘strike’ – on or before a set date. Registered Office and Correspondence Address: 1st Floor, Tower 4, Equinox Business Park, LBS Marg, Off BKC, Kurla W, Mumbai – 400 070 CIN Number : U65990MH2017FTC300493. As part of our review process, all brokers had the opportunity to provide updates and key milestones in a live meeting that took place in the fall. A trader who expects a stock’s price to decrease can sell the stock short or instead sell, or “write”, a call. Lot Size: Lot size refers to a fixed number of units of the underlying asset that form part of a single FandO contract. Why we picked it: Options traders will appreciate that the broker charges no contract fee, which is still a relative rarity among brokers — especially ones that have the sort of advanced options trading features Firstrade offers. Then, you can set up recurring deposits into these for however much you want i. 5 Trading Psychology Stages to Consider. Bug fixes and performance improvements. There is a probability that the Pattern turns out to be a rectangle pattern a rectangle is a chart pattern formed when the price is bounded by parallel support and resistance levels when the Pattern fails to break out. There was no prior warning or no answers given still by the customer service and it’s been months.

Paul Krugman, Wells Robin

European Economic Area. Prematurely entering a trade before the breakout can result in losses if the pattern fails to complete. A platform with quick speeds low latency, real time data, and advanced charting abilities is a must for day traders. Some brokers also allow you to purchase. Tweezer Bottom Pattern. Every chart pattern should tell you a story, much like candlestick patterns. When you have free trades, you have to realize that these investment companies are making their money one way or another. Before you start practicing algorithmic trading, chances are that you feel that it is a difficult process. This process might get a bit confusing. Use limited data to select advertising. Create profiles to personalise content. It doesn’t stand a chance. Live performance does not include any backtested data or claim and does not guarantee future returns. Neither coverage protects you from market losses. Com DeFi wallet allows users to store their crypto and earn rewards on their assets. Many experts suggest that it may be better to avoid taking a position within the first hour of trading. Com and oversees all testing and rating methodologies. Because reading through insider transactions filings published on the financial regulators’ websites is a tedious task, we gather this data, analyze it and publish it so that you can find the data you need easily. Strangles Options Strategies. This is also known as the short term wholesale power market, especially in contrast to long term power trading on the power futures market. At The Motley Fool Ascent, brokerages are rated on a scale of one to five stars. And remember, the shorter your time horizon and the more trades you make, the more you’ll rack up in transaction costs. Unlike traditional investing, which involves holding positions for extended periods, intraday traders aim to capitalize on short term price fluctuations within a single trading day. Post entry damage control measures include exiting part of the position to cut risk or tightening stop loss orders based on post gap price action. Technical analysis is the reading of market sentiment via the use of graph patterns and signals. INZ000038238 Registered Address: ZerodhaBroking Ltd. Some commodities, like gold for instance, have a reputation for being a safe haven in troubled times and are often used as hedges against things such as inflation and macroeconomic volatility. You will have losing days, and even losing weeks and months. Moreover, the rise of HFT algorithms has made it increasingly difficult for individual traders to compete effectively in many markets.

Necessary

In today’s digital age, innovative concepts are constantly emerging in the world of online commerce, and one of the latest trends to capture attention is color trading. In total, eToro allows you to buy and sell 16 different cryptocurrencies in the traditional sense. If the stock does drop to $50 or below, with enough volume available at that price, the order will fill, and the investor will buy the stock for $50 or less. They involve identifying the direction of the market trend and making trades in the same direction, with the intention of capturing momentum swings within that trend. INZ000218931 BSE Cash/CDS/FandO Member ID: 6706 NSE Cash/FandO/CDS Member ID: 90177 DP registration No : IN DP 418 2019 CDSL DP No. Other things to consider are fee structures, on the go accessibility, stock analysis tools, and educational resources. Exchange has published Member Help Guide and new FAQs for Access to Markets. Few investing and retirement resources. ETRADE, Investopedia’s choice as the best online broker for mobile investing and trading, solidifies itself as a pioneer in both mobile and online trading by offering two well designed mobile apps. Most brokers in the United States, especially those that receive payment for order flow do not charge commissions. Below is the full list of companies we researched, along with links to individual company reviews to help you learn more before making a decision. In the United States, the legal minimum balance requirement for starting day trading is $25,000. 100% Safe and Secure. 24/7 dedicated support and easy to sign up. Unfortunately, the goal of these schemes is to move the stock price higher with a quick burst of hype followed by insiders selling the stock to take advantage of the run up. These candles have little or no shadows.

FOR CORPORATES

An ATM option is one that provides zero cash flow no profit/no loss if it is exercised immediately. These instruments serve as tools for investors to hedge existing positions or speculate on future price movements. Past performance of any security, futures, option, or strategy is not indicative of future success. Obviously, this shouldn’t be so. Let’s look at what happened in the chart, step by step. Extensive research and screeners. In view of this new process, as specified by the regulatory and the cut off time of Clearing Corporation/Banks processing the funds, Bajaj Financial Securities Limited cannot commit the exact time for releasing funds payout to its client. By studying these charts and applying technical analysis techniques, traders can make informed trading decisions and increase their chances of profitability. The content published on this website is not aimed to give any kind of financial, investment, trading, or any other form of advice.

Track Market Movers Instantly

Get it in the Microsoft Store. On NerdWallet Advisors Match. Not all brokerages or online trading platforms allow for all these types of orders. Contrarily, if the market moved against your speculation, you’d incur a loss. Options trading enable investors to be more dynamic than buying and selling stocks. It effectively indicates the level of volatility in the market, a crucial factor affecting options prices. Primarily, there are five types of share trading. As a result of these events, the Dow Jones Industrial Average suffered its second largest intraday point swing ever to that date, though prices quickly recovered. His work has been published by Vanguard, Capital One, PenFed Credit Union, MarketBeat, and Fora Financial. Avoid Knee Jerk Reactions: Remember, a Doji doesn’t demand immediate buying or selling; it’s a sign of uncertainty. It covers everything from basic concepts through to advanced indicators, and includes more than 400 charts to bring technical analysis to life. Margin trading increases your level of market risk. This means that you could make significantly more than you could otherwise. It’s important to note that triangle patterns are not a guarantee of future market movements because of the increase in manipulation in today’s era as more and more retail public try to find triangles for trading opportunities, and traders should be aware of the potential for false or failed breakouts. Please remember that, although hedging could lessen your risk, you’ll still incur fees on both positions, which should be figured into all your calculations. In the end, it all boils down to context and the story of buyers and sellers behind the tape. The stop loss can be a dollar amount or a percentage. Please review the terms, fees, and features of any trading or investment app carefully before use. Not Using a Demo Account. Other issues include the technical problem of latency or the delay in getting quotes to traders, security and the possibility of a complete system breakdown leading to a market crash. OK92033 Insurance Licenses. This results in a change in trend to the downside. A protective put is also known as a married put. ETRADE is a top performing broker whose highlights include $0 trades, two excellent mobile apps and the Power ETRADE platform. It provides best facilities which are big in the need for a smooth and well the start. Technical analysis is crucial in identifying key levels and chart patterns that can help determine entry and exit points.

Essentials

A position can be traded up to 30 minutes prior to delivery. A price movement at the fifth decimal place in forex trading is known as a pipette. It contains two sections, credit and debit, which will be filled with the required elements. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Leveraging the latest data, this tool provides a comprehensive view of the Call and. In the futures market, futures contracts are bought and sold based on a standard size and settlement date on public commodities markets, such as the Chicago Mercantile Exchange CME. Moving from paper share certificates and written share registers to “dematerialized” shares, traders used computerized trading and registration that required not only extensive changes to legislation but also the development of the necessary technology: online and real time systems rather than batch; electronic communications rather than the postal service, telex or the physical shipment of computer tapes, and the development of secure cryptographic algorithms. Therefore, tracking the market consistently becomes a priority for a day trader to make a profit. As I previously mentioned, you will be charged interest on the borrowed funds when trading with leverage. “Kudos to the team behind this app. Swan is the best way to accumulate Bitcoin with automatic recurring and instant buys using your bank account, or wires up to $10M.

Trading

We’ve got you covered. Day traders specialize in making small profits on a large number of trades and avoid keeping positions open overnight. Set a price at which you would like to buy the stock and stick to it, even if it means that you may not get a chance to buy the stock. Referring to the above image, you can see there is a huge buying volume on the gap up candle, but the next consecutive candles have selling volume, hence indicating that the gap will be eventually filled during the day. These algorithms can make decisions based on real time data and react rapidly to market changes. A broadening top and bottom is a technical analysis chart pattern that forms as the price swings widen between two diverging trendlines. You could harness paper trading for a few months, for example, before switching to executing trades with actual money. Brokerage will not exceed the SEBI prescribed limitSecurities: KYC is a simple one time process that has to be undergone while investing in securities markets When KYC is done through a SEBI registered intermediary broker, DP, Mutual Fund etc. Knowing intraday trading timing can help you make the most of the available time, which plays a vital role. Here, we explore the quotes about discipline in trading, offering a foundation for building a resilient trading philosophy grounded in the wisdom of the masters. Complies with the legal and regulatory requirements where it operates;. For my methods, I don’t need to know. EQUITY TRADING IPO OPTIONS TRADING FUTURES TRADING. IG offers an impressive suite of proprietary mobile apps, led by its flagship IG Trading app also known as IG Forex, which boasts a well designed layout teeming with features such as alerts, sentiment readings, and highly advanced charts. Freelancing has been on the up and up in recent years, and the pandemic has only been a catalyst for the movement. However, for beginners, it offers all they need to start – buying and selling crypto. Furthermore, traders use various technical indicators such as Moving Averages, Relative Strength Index RSI, MACD Moving Average Convergence Divergence, and others to analyze price patterns, trends, and momentum. The profitability of day trading depends on several factors, including the trader’s skill, strategy, and the amount of capital they can invest. For instance, during a trading session with high activity, a tick chart will generate more bars, giving you more granular data on price changes. Subscribe on YouTube. Risk capital is money that can be lost without jeopardising ones’ financial security or lifestyle. For things like consumables or raw materials, it needs renewal every eighteen months. Content marketing is heavily moderated. Let’s imagine that we were trying to enter the market on May 4th if a bullish signal was confirmed.

Categories

That said, though theoretically, intraday ends at 3:30 pm, you don’t get to trade till then. Overall though, the basic funtions and options are often more than enough for majority of users. Saxo Bank A/S Headquarters Philip Heymans Alle 15 2900 Hellerup Denmark. As an intraday trader, you want to pick the market direction early. The reader bears responsibility for his/her own investment research and decisions. It is fine as long as you are aware that the impact of leverage through margins works both ways; in case of profits and in case of losses. Therefore, social trading networks provide an innovative framework for delegated portfolio management. However, our opinions are our own. Based on your interests, you can tailor who you follow in the feed. You’ll need a quiet, distraction free workspace where you can concentrate on your trading. Bollinger bands aim to identify the price range of a particular stock. This stage is similar to when you are buying your first car. For newer traders, even reading candlestick charts can seem like an insurmountable learning curve. Com and Schwab Mobile. For example, if the exercise price is 100 and the premium paid is 10, then a spot price between 90 and 100 is not profitable. Top tier educational content, screening tools, and research capabilities. This generally means that the demand for the asset is on the uptick but isn’t strong enough yet for a breakout. Traders aim to take advantage of short term pricing fluctuations in the market.