Bookkeeping

What is the difference between periodic and perpetual inventory systems?

Perpetual LIFO also transfers the most recent cost to cost of goods sold but makes that reclassification at the time of each sale. A weighted average inventory system determines a single average for the entire period and applies that to both ending inventory and the cost of goods sold. A moving average system computes a new average cost whenever merchandise is acquired. That figure is then reclassified to cost of goods sold at the time of each sale until the next purchase is made. Each time this figure is found by dividing the number of units on hand after the purchase into the total cost of those items.

Advantages and Disadvantages of the Perpetual Inventory System

As you can see, the average cost moved from $87.50 to $88.125—this is why the perpetual average method is sometimes referred to as the moving average method. The Inventory balance is $352.50 (4 books with an average cost of $88.125 each). When using the perpetual inventory system, the general ledger account Inventory is constantly (or perpetually) changing.

2: Compare and Contrast Perpetual versus Periodic Inventory Systems

Therefore, the perpetual FIFO cost flows and the periodic FIFO cost flows will result in the same cost of goods sold and the same cost of the ending inventory. In a perpetual system, you will sometimes need to estimate the amount of ending inventory for a period when preparing financial statements or if stock was destroyed. To calculate this estimate, start with the beginning inventory and cost of purchases during the period. Perpetual inventory systems are helpful for those who always need to understand margins and profitability. A large business with many products or a company that wants the ability to scale an emerging business over time would use a perpetual inventory system.

Perpetual Inventory System vs. Periodic Inventory System: An Overview

- Perpetual LIFO and Periodic LIFO are two methods of inventory valuation that use the Last In, First Out (LIFO) principle, but they apply this principle in different ways.

- The real value of perpetual inventory software comes from its ability to integrate with other business systems.

- For companies under a periodic system, this means that the inventory account and COGS figures are not necessarily very fresh or accurate.

- Regardless of the type of inventory control process you choose, decision-makers know they need the right tools in place so they can manage their inventory effectively.

- The perpetual system may be better suited for businesses that have larger, more complex levels of inventory and those with higher sales volumes.

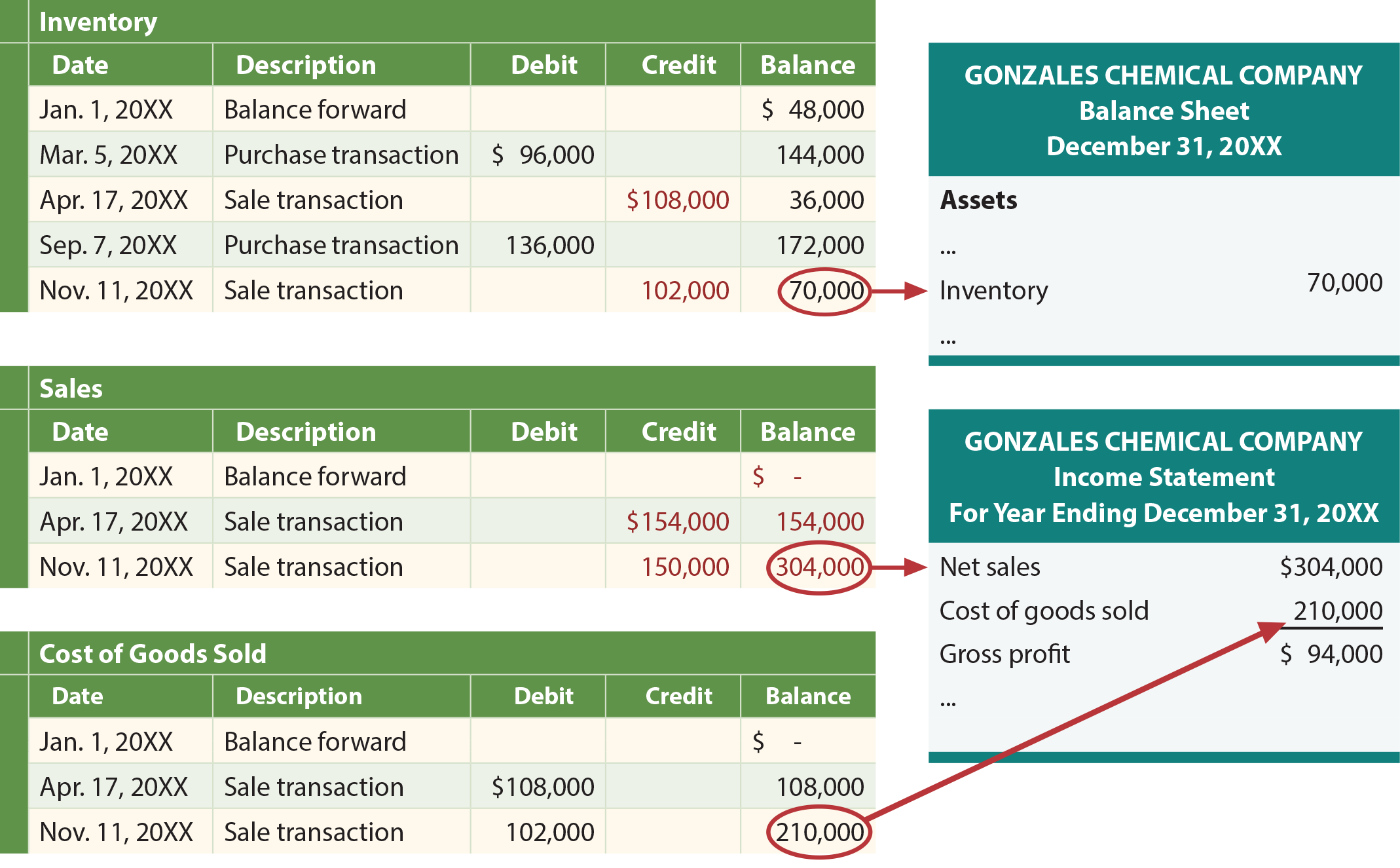

The following table, ledgers, and financial statements reveal the application of moving average. Perpetual inventory systems are generally considered more accurate because they reflect real-time inventory levels. Periodic systems can have discrepancies due to shrinkage (like theft or damage) that occur between counts. In the perpetual inventory system, we record our purchases in the Inventory account rather than the Purchases account. In other words, we record inventory purchases as assets rather than expenses.

Inventory refers to any raw materials and finished goods that companies have on hand for production purposes or that are sold on the market to consumers. Both are accounting methods that businesses use to track the number of products they have available. When a sales return occurs, perpetual inventory systems require recognition of the inventory’s condition. Under periodic inventory systems, only the sales return is recognized, but not the inventory condition entry. Under the perpetual inventory system, an entity continually updates its inventory records in real time. Let’s first go over the journal entries for inventory purchase, then segue into inventory sale and end-of-year inventory count for both perpetual and periodic inventory systems.

This is done through computerized systems using point-of-sale (POS) and enterprise asset management technology that record inventory purchases and sales. It is far more sophisticated than the periodic system of inventory management. This means the average cost at the time of the sale was $87.50 ([$85 + $87 + $89 + $89] ÷ 4). Because this is a perpetual average, a journal entry must be made at the time of the sale for $87.50. The $87.50 (the average cost at the time of the sale) is credited to Inventory and is debited to Cost of Goods Sold.

This entry must be made every time there is a sale, which is why the perpetual system should only be used with accounting software that will make the necessary calculations. We’ll illustrate the difference between the periodic vs perpetual inventory system by showing the journal entries made when you purchase inventory, sell inventory, and then count inventory at the end of the year. We’ve kept the cost of the inventory how to calculate accounting rate of return constant throughout the example, so your cost-flow assumption won’t matter. The advantage of a perpetual system in providing a rolling estimate of COGS is clear. A company knows, after each transaction, how much it costs to produce products sold at that point. To calculate inventory, companies need to set up a system where every piece of inventory is entered into the system and deducted from the system as it’s sold.

The only difference between the two cost flow concepts is how rapidly a cost layer is stripped away or replenished in the costing database. Under perpetual LIFO, there can be a great deal of this activity throughout a reporting period, with inventory layers being added and eliminated potentially as frequently as every day. This means that the costs at which items are sold could vary throughout the period, since costs are being drawn from the most recent of a constantly varying set of cost layers. In a periodic LIFO system, inventory records are only updated at the end of a reporting period.

One of the main differences between these two types of inventory systems involves the companies that use them. Smaller businesses and those with low sales volumes may be better off using the periodic system. In these cases, inventories are small enough that they are easy to manage using manual counts.

Using the given information, calculate the cost of goods sold, the gross profit, and the ending inventory. A perpetual inventory system automatically updates and records the inventory account every time a sale, or purchase of inventory, occurs. You can consider this “recording as you go.” The recognition of each sale or purchase happens immediately upon sale or purchase.

Instead, purchases of merchandise are recorded in the general ledger account Purchases. If Corner Bookstore sells the textbook for $110, its gross profit using periodic FIFO will be $25 ($110 – $85). If the costs of textbooks continue to increase, FIFO will always result in more gross profit than other cost flows, because the first cost will always be lower. In recent years, advances in inventory management software and the ability to integrate it with other business systems have made perpetual inventory a more practical and powerful option for many businesses.